Crisis in the trading company BSW Windows. Anti-crisis management Project management during a crisis

Interest in the application of project management methods in recent years has shown rapid growth, and in all sectors of the economy. In the course of the “growing up” of Russian project management, the forms of interest changed, and after them, the configuration of consulting services. Project management in a crisis is very different from project management in "fat" years.

Even 10 years ago, project management issues were considered more like a fashion or even a kind of "fetish" of individual managers. The very inclusion of the words “project”, “project management” into the managerial lexicon was considered useful. But by the end of this period, the level of general theoretical knowledge became higher and the demand for project management services became more concrete. The tasks of project management began to be tied to the current processes of companies, organizational structures, and development strategies.

Many Russian companies, following the Western ones, reoriented themselves and instead of large-scale implementation of difficult solutions, which usually drag on for years, they began to choose the solution of selected tasks. Some companies, following the Western trend, decided to completely transfer individual project management functions to the area of responsibility of an external professional team. Outsourcing began to stand out as a separate business line of many consulting companies.

Another feature of the development of project management in Russia in recent years is the increasing attention to this area on the part of public authorities. And not only at the regional, but also at the federal level. And this is understandable, because the implementation of large-scale projects of national importance (PNP, state and targeted programs) requires transparency of management, efficiency and validity of decisions made, and quality of planning. All this is very well manifested in the example of the largest state program of recent years - preparations for the 2014 Olympic Games, in the implementation of which we are directly involved.

But, despite the rapid development, the project management market approached the crisis in a motley manner. Growth problems emerged from globalized customer goals that were not driven by readiness and real needs, from “loose” solutions by a number of contractors that were hastily building control systems due to growing demand.

But, despite the rapid development, the project management market approached the crisis in a motley manner. Growth problems emerged from globalized customer goals that were not driven by readiness and real needs, from “loose” solutions by a number of contractors that were hastily building control systems due to growing demand.

Difficult present

The global financial crisis has made its own adjustments and changed approaches to project management during the crisis. However, its influence cannot be assessed only as negative. Moreover, according to the observations of our consultants, the crisis has sown the seeds of new interest, new opportunities and new areas of application of project management approaches.

In the second half of 2008, many companies were at a loss and froze their investment budgets. Now the situation is seriously changing. Those companies that turned out to be more efficient than their competitors, whose management was ready not to sit idly by in the face of uncertainty, are now demonstrating their readiness for internal development. More far-sighted management is making efforts to develop the business, aimed at further improving its efficiency.

In addition, right now, when many have gained indispensable experience of surviving during the crisis, there is an increase in investment activity. Companies are looking for new areas for their business, diversifying investments, investing in projects that imply long-term return on investment.

If before the crisis the priority was shifted towards projects designed for endless consumer demand (for example, development projects), now investors are ready to consider the possibility of investing in long-term development projects. The prospects for the creation of new industries, the development of new technologies that will bring profit in the future are considered. This is facilitated by the state, which is increasingly using tools to support such projects.

Naturally, an investor, agreeing to long-term investments, wants to minimize their risks. This can only be achieved by improving the quality of project and program management. That is why - in connection with the growing requirements for the project management system, monitoring and reporting, companies are turning to professionals in this field for such services.

If earlier a lot was built on trust, now the choice of a professional team capable of providing an effective and transparent management system is coming to the fore. Built-in monitoring by the Investor or the Customer is an almost mandatory feature of investment projects - people want to check and control.

In a crisis, the management of state programs does not go unnoticed. The federal authorities, being one of the largest investors in Russia, require the processing of project management “slogans” into working solutions.

The experience of implementing projects during the crisis year shows that development has not stopped. Commercial companies are implementing individual elements of project management systems that lay the foundation for future development. Specialized solutions are being introduced on program-target methods of management in state authorities (in the Ministry Agriculture Russian Federation, in organizations implementing the state program of preparation for the 2014 Olympic Games and many others). The theoretical base of Russian project management is expanding - new national standards are being created in the GOST R system.

Forecasted prospects

Forecasted prospects

According to our analytical research, despite all the current difficulties, project management in Russia is only strengthening its positions, becoming a powerful tool in the struggle for efficiency and competitiveness.

The lull in the market at the end of 2008 and the first half of 2009 is replaced by an increase in the number of “hot” calls and pre-sales. Some of them are characterized by small budgets - companies are in search of a direction for development, points of support in the new conditions. But this is an inevitable reality dictated by the recession.

New value criteria are being formed for project management services: quick and concrete utility, the ability to completely delegate responsibility for blocks of specific work to professionals, providing company management with timely, reliable and sufficient information for decision-making.

New value criteria are being formed for project management services: quick and concrete utility, the ability to completely delegate responsibility for blocks of specific work to professionals, providing company management with timely, reliable and sufficient information for decision-making.

The second half of 2009 is characterized by the readiness of the Customers to make decisions on the transition to contractual stages of relationships in consulting, outsourcing and implementation of information systems. The number of ongoing projects has already reached the pre-crisis level.

However, today's demand structure is different from the pre-crisis period. The types of projects being implemented, the services in demand, the requirements for the management system on the part of Customers and Investors have changed. The actual re-profiling of the market, in turn, determined the need for changes in consulting companies as well. Some of them could not adapt to the new requirements and weakened their positions, which led to a redistribution of the burden on stronger market participants.

This trend is felt by the GC "Project PRACTICE". Due to the growing interest in project management, we are considering the possibility of abandoning the previously used anti-crisis discount programs, which, of course, will not affect Customers with whom partnerships have already been established or contracts for the provision of services have been concluded. At the same time, it is not planned to introduce new systems of discounts for consulting and outsourcing services in the near future. The services of real professionals with vast experience in project implementation remain in demand and cannot be cheap.

In general, the forecast for the development of the project management market, according to our specialists, is positive, and it is this market that can turn out to be a lever for overcoming the crisis of the entire Russian economy.

Mikhail Kozodaev, Managing Partner,

Consulting DirectorGK "Project PRACTICE"

Views: 2 810

A lot has already been written about the crisis, its causes, negative manifestations and ways to overcome it. Among the recommendations there are many that deserve attention and can be used in real practice. But it is very important to understand that the main condition for any successful work is consistency, which in a crisis becomes a critically necessary attribute of business management. An attempt is made below to systematically present all anti-crisis measures. The system is shown in fig. 1, it has the shape of a fish, which is called the Isshikawa diagram.

Rice. one.

Let us give a brief description of each of the factors shown in the general diagram. All of the following is an attempt to systematically integrate an integral set of anti-crisis management measures. This does not mean that all measures must be taken. After reviewing the contents of this paragraph, the manager himself must choose what suits him best and on what he should focus his efforts.

Strategy adjustment. As you know, the fish begins to deteriorate from the head. Therefore, it is necessary to start by adjusting the strategy. Leaving the company's mission unchanged, its vision should be reconsidered, refusing, apparently for a while, from achieving large ambitious goals. Although the conditions of the crisis may provoke the emergence of new ambitious goals, for example, in terms of capturing the market of bankrupt companies or acquiring weaker companies that have little chance of survival. It must be remembered that the crisis creates additional conditions for development, if you correctly use the emerging opportunities.

Reconsider your attitude to the crisis based on the following positive factors:

- The crisis stimulates consolidation:

- cheapening of assets will lead to the fact that the weak will die, the strong will become even stronger,

- consolidation will most likely occur in retail grocery and household goods, banks, pharmacies, etc.

- Managers will get the practice of managing in a crisis.

- There will be a reassessment of the system of risks, which were considered too formally in the last period. After the crisis, risk management will become a more effective management tool.

- Several “soap bubbles” are “blown away”, in particular, stock, real estate, oil, metals…

- The position of strong domestic players may be strengthened by a possible reduction in competition from imports and additional export opportunities.

The listed factors are named here rather conditionally. They will be positive for those who can dispose of them. And this may be the new strategy of the company.

Productivity increase. In a crisis, the decisive factor in maintaining the effectiveness of the company is speed. It turns out that the well-known formula of general relativity works in business: E=mc2 , however, with some amendments. E is the performance (performance) of the business, m is the mass (volume) of the resource used, and c - the rate at which this resource is used. The whole point here is that the speed is taken in the square, i.e. has an order of magnitude greater impact than the amount of resource used. In the period leading up to the crisis, most of the company, to put it mildly, "relaxed somewhat." The main focus was on mass m , and not at speed: a large “back office” staff was hired, the salaries of key specialists were constantly growing, realizing their importance, key specialists demanded comfortable conditions (expensive personal cars), hospitality expenses were constantly growing, expensive offices were built or rented. This list could be continued. Things got to the point that young graduates of the capital's universities demanded a starting salary of $1,000. At the same time, no one thought about speed.

The crisis came and put everything in its place. There was a rapid reassessment of values. The question was posed point-blank: “Gentlemen, highly paid managers, if you were not able to foresee the crisis and now you cannot overcome its consequences, then why do you receive high remuneration and why do business need you at all. Either turn on the high speed of your activity, or - goodbye, just goodbye, and not goodbye. Only those who can effectively work will remain. But being efficient doesn't mean running fast around the office. It is necessary to quickly and in detail analyze all factors of business productivity growth, if possible, excluding all activities that do not bring value to business processes. This refers to both technological and operational processes. In most cases, it is quite difficult to increase the speed of technological processes, as quality may suffer. At the same time, most organizational processes have huge reserves of acceleration. And here it is not necessary to thoughtlessly reduce staff, saving costs. Usually on the contrary, in order to increase productivity, additional costs must be incurred. At one enterprise well known to the author for the overhaul of gas wells, instead of one operator, at a certain stage of the technological cycle, they began to use two, i.e. increased costs. As a result, equipment downtime has been reduced to zero, and the rate of well workover has increased. And speed, as Einstein's formula says, is squared. In combination with other similar techniques, the amount of work performed by one team during its shift has increased. In the end, it became possible to reduce one of the five permanent teams altogether, without losing the overall turnover. The company's profit increased sharply due to the reduction of fixed costs.

This recipe is not universal - it is useful when production has a large amount of fixed overhead. As the ancient sages said, truth is always concrete. In each case, it is necessary to find those ways of improving productivity that are acceptable for a particular business. And no one, except for the specialists working at the enterprise, can do it better. True, certain tools can be recommended to these specialists.

One such tool is the Theory of Constraints (TOC) proposed by E. Goldratt. Note that this is an integral system of technologies, which in its essence reproduces the model of the weakest link, well known in technology. Suppose we want to strengthen the chain (improve the system). Where would it be most logical to focus your efforts? On the weakest link! Is it worth reinforcing something else, something that is not a limitation? Of course not. The weakest link in the chain will still break, no matter how we strengthen the rest. In other words, the effort put into the constraints will not cause immediate and noticeable improvements in the performance of the system.

Goldratt developed his approach to continuous improvement and called it The Theory of Constraints (TOC). He even described it in novels that demonstrate the use of TOC technology.

Changing attitudes towards marketing. The fears of all marketing agencies in a crisis are justified in the fact that "now all companies will start cutting marketing budgets." Indeed, this is really observed during a crisis: being in a panic, companies begin to reduce what they can temporarily do without. This is, first of all, the cost of training and promotion of products on the market. Such measures look justified only at some, perhaps the very initial stage of the development of the crisis. If this strategy continues in the future, the company may simply lose its competitive advantage. The staff will not be able to solve the tasks that management sets for them, and the market will gradually forget about these competitive advantages.

Basically, there are two alternative attitudes towards marketing in a company.

Alternative 1. Marketing is the policy of consumers within the company, forcing the company to smoothly change in the direction desired by most consumers. Companies address consumers in the market like this:

- "We will give you anything you want if you become our loyal customers."

- "We are ready to spend a lot of money, if only you were our customers."

Alternative 2. Marketing must be profitable. In other words, marketing must measure the costs of promoting products with the result that is obtained as a result of numerous marketing programs in terms of understandable economic indicators, such as profit, cash flow, etc.

In a crisis, a shift will occur in the direction of the second alternative. But it can be achieved in different ways. The owner and management of the company can take the first, radical path. It's easy to cut down on the company's marketing staff as much as possible while slashing the budgets of all marketing programs. The problem asks whether there will be an economic effect from this. Undoubtedly yes! The reduction in total costs caused by such a reduction will lead to an increase in profits and cash flow: “Thanks to marketing, it helped us save costs, and, as you know, money saved is wage money.”

The second path within the framework of the profitable marketing alternative involves conscious behavior: 1) we soberly assess the situation, 2) we are looking for new opportunities. What is the first thing to evaluate? Most companies produce several types of products and offer them in different markets. One operating unit can serve several markets at once, with different perspectives. Different operating units may operate in the same demand area. So how many lines of business does the company actually have? Why is it important. The well-known 80/20 rule works here: 80% of the results of any activity are provided by 20% of the efforts. In a crisis, a company cannot afford to scatter resources on non-core (non-profitable) activities. First of all, it is worth focusing the attention of marketers on promising products and activities, focusing all marketing costs on this segment.

Management of economic factors. The main manifestation of the crisis from which business suffers is the lack of money. On fig. 2 is a diagram explaining the causes and manifestation of lack of money.

Rice. 2.

So, there are only three main reasons: 1) the company does not manage to sell a lot, 2) the company incurs high costs, 3) the company does not know how to manage working capital. These three reasons may not appear in standard, non-crisis circumstances, but in crisis conditions they arose due to the unwillingness of management to reorganize to work in new conditions. Worst of all, when all three causes appear at the same time, which most often happens. As you can see from the diagram, the indicators that signal to management that a problem has arisen are profit and cash flow. What should the management team focus on first in order to at least reduce the impact of the lack of money problem - on profits or on cash flow. Profit is a necessary but not sufficient condition for obtaining money. In other words, to ensure the company's ability to generate money, it must make a profit. In standard, non-crisis conditions, this condition is considered unshakable. But in a crisis, you need to generate money in any way, and do it quickly. What happens during a crisis? Sales are falling. This is a deep reason. It is not possible to fix it quickly - the markets are shrinking. Partial compensation for the drop in sales may occur due to cost reduction. This is what companies “know how” to do best. But it is not a fact that cost reduction will not lead to an even greater drop in sales, which will eventually lead to even greater losses. We discussed this possibility when analyzing marketing aspects.

During a crisis, a company needs time to restructure its activities in relation to crisis conditions: shrink, cut some activities, optimize staff. After such a restructuring, the company will learn to live in a new way and make a profit, most likely in smaller volumes, but adequate to shrinking markets. During this restructuring, the company will not be able to live without money. Therefore, money must be made or saved at any cost. So, from the two indicators of the scheme in Fig. 2 more important is the indicator of operating cash flow, rather than profit, at least in the initial stages of the crisis.

And here comes the technology of Total Money Management, or TCM, from the English term Total Cash Management. The essence of TCM is manifested in the practical implementation of the following two fundamental provisions:

- 1) all aspects of the enterprise's activities must involve available or fundamentally available financial resources,

2) each employee of the enterprise can influence the state of monetary resources by applying some simple rules everyday.

In many real situations, managers of enterprises in the course of their activities do not realize the exceptional importance of money. They do not understand that money is a completely liquid asset. Having money, an enterprise can solve absolutely all problems, both technological, and marketing, and all the rest. This is especially acute in times of crisis. The pragmatic goal of TCM is to create a system that:

- on the one hand, it contributes to the efficient generation of cash flows,

- and on the other hand, it contributes to their no less effective use, again with the aim of generating subsequent cash flows.

It is important to understand that TCM does not consist of "Save Money" slogans alone that must be posted throughout the firm in order to succeed. This is far from the case: TCM is, first of all, a system that covers all the activities of the company. The figure shows the main blocks of TCM.

Rice. 3.

The systemic nature of the TCM concept is manifested not only in the fact that each functional unit and even each person plays a role in the implementation of strategic goals, but also in the fact that an additional effect can be created at the junction between units. In other words, improvements in one of the blocks shown in the figure may cause changes in other blocks so that the cumulative effect may be either greater or less than the sum of the two individual effects.

Transformation of investment and financial activities. It is generally accepted that during a crisis, investment activity should be reduced. Real practice proves this, judging by the numerous reports of the suspension or cessation of the construction of new production facilities, the cancellation of earlier decisions taken about investment. The reduction in investment activity is due to the fact that 1) there is simply not enough funds, 2) the prospects for new investment projects are unclear.

At the same time, the crisis provides an opportunity to increase the company's assets and expand the scope of its activities through the absorption of other weaker enterprises. There is no doubt that in a period of crisis there is a redistribution of property - the strong absorb the weak.

So, the transformation of investment activity should be considered from two positions:

- 1) developing an attitude towards investment decisions made before the crisis,

2) analysis of opportunities to increase investment activity by acquiring new assets, using a probable decrease in their price.

In a crisis, the procedures and technologies used for conducting the investment activity itself should be reviewed. Here are typical features of the investment activity of domestic companies:

- The task of investment development, which is important for business, is solved through outsourcing (assigned to a consulting company).

- Closed software products such as Project Expert are used, which do not provide a transparent idea of the business for the owner and management.

- The focus is on cash flow forecasting and calculation of standard indicators (NPV, IRR, DPB) without deep insight into the practical economics of the project. At the same time, the choice of the discount rate does not correspond to the specifics of project financing.

- Investment analysis lasts for 2-4 months and ends with a rather cumbersome description containing many unnecessary details.

- It is often not possible to trace a direct link between a business idea and/or technological improvement and the economics of the project.

In a crisis, this is not good. The main task of investment design in a crisis environment is as follows:

We do it for ourselves, quickly and without errors.

So, as before, the speed and quality of decisions made. Agree that there is nothing simpler than making a decision to buy companies that are rapidly losing their effectiveness, as a result of which their owners are ready to sell them cheaply. And then what? Resell to someone for a higher price. This is what so-called portfolio investors usually do. It is not certain that this speculative operation will be successful. So, you need to buy, following the strategic goals. During the crisis, the takeover of weak companies will be carried out mainly by a strategic investor. The latter, by definition, will seek to develop the purchased object in order to earn even more money on it.

The strategic investor has two problems. First, you need to act quickly, otherwise another strategic investor will get ahead. Secondly, you cannot make a wrong decision, otherwise the money spent will not be returned. To minimize the risks of these two mistakes, the investment technologies used must meet the following requirements:

- The technology must allow quick and correct conclusions about the feasibility of investments.

- Technology must be flexible, i.e. able to make multiple recalculations depending on changing conditions.

- Technology must be individual, i.e. reflect the features of the existing business and the special requests of the owners and top management.

- Technology must be open and transparent: the occurrence of each indicator must be traced ( widely used Project Expert does not meet this requirement).

- Technology must be as clear as possible for a possible potential investor: it is enough to show justify marketing forecasts and show financial tables, and the investor is ready to make a decision.

If a company owns such technology, it is able to avoid these mistakes. Otherwise, enterprises with a negative economic result will be bought and resold.

Financial activities companies in a crisis occurs in the most stressful conditions. In essence, all enterprises are moving to a starvation financial ration. This primarily concerns credit sources of financing.

Having problems with money, the head of the company should not “write off” all of them for the crisis. A crisis, even an external one, actually reveals the company's hidden problems. There are three groups of reasons that lead the company to a shortage of money. The first group includes market reasons, which can be both external and internal. These are, first of all, a drop in sales volumes and shortcomings in assortment management. Indeed, sales volumes may fall due to an external cause, i.e. due to market shrinkage, or may be the result of an imperfect marketing strategy of the company. Even if markets shrink, the marketing strategy must find a way to maintain volume. Among the internal causes of the shortage of money is the imperfection of the financial management system, which manifests itself in

- lack of management accounting

- poor financial planning

- low qualification of financial managers,

- suboptimal financial management structure,

- loss of control over costs.

The emerging external crisis should reveal all internal causes, increasing the perfection of all aspects of the company's activities, in the face of objectively existing external causes.

What to do to reduce the shortage of money. First of all, one should not succumb to panic and systematically present the directions in which it is necessary to act. The system of measures presented in fig. 4 looks very simple.

Rice. 4.

Having built a kind of Procrustean bed of the system, it is necessary to think through the possible ways in detail. These measures will vary from company to company. Below is a list of the most typical measures for each of the groups.

- Short-term measures to increase the inflow of money:

- sale or lease of non-current assets,

- rationalization of the product range,

- restructuring of receivables into financial instruments,

- use of partial prepayment,

- development of a system of discounts for buyers,

- attraction of credit sources of short-term financing.

- Short-term measures to reduce the outflow of money:

- cost reduction,

- deferment of payments on obligations,

- use of supplier discounts,

- revision of the investment program,

- tax planning,

- bill settlements and offsets.

- Long-term measures to increase the flow of money:

- additional issue of shares and bonds,

- restructuring of the company - liquidation or separation into separate business units,

- search for a strategic investor,

- looking for a portfolio investor.

- Long-term measures to reduce the outflow of money:

- long-term contracts providing for discounts or deferred payments,

- tax planning.

It is clear that not all of the above measures are equally available in times of crisis; this applies, for example, to the additional issue of shares or bonds. However, a systematic search for financial opportunities should lead to success.

Mega motivational system. This aspect of the overall program for the transformation of the company's activities in a crisis is shown in the diagram in Fig. 1 in the form of a fish tail. As you know, with the help of its tail, the fish increases the speed of its movement. This is the meaning of the mega-motivational system. All of the above factors of restructuring the company's activities should start to work very quickly, as many leaders like to say: "I need to do it yesterday." How to make it all start working as soon as possible? The fundamental answer is simple: it is necessary to put the company's personnel in conditions when they themselves will be interested or forced to do it. I remember a fragment of the film “Peculiarities of the National Hunt”, when a cow was transported in an airplane bomb bay. She could not be ejected from the bomb bay. Then the commander very figuratively put it: “if you want to live, you won’t get so upset.”

This is the fundamental meaning of the term megamotivation. Megomativation can be implemented in two polar ways:

- 1) reduce N% of the staff, motivating the rest with the opportunity to continue working,

2) switch to pay-by-result, giving people the opportunity to earn by achieving higher goals that appear as a result of the crisis.

The first way is trivial, but it can be effective. The final effect of this method will be determined by the extent to which the manager correctly “cleanses” the ranks of his staff. If the remaining staff can “spread out” in order for everyone to survive, then the effect is guaranteed. If they start flying out of the bomb bay, it means that they “cleaned out” the wrong ones.

In this sense, the second way more insured against mistakes. The company's staff is far from homogeneous in terms of their managerial skills and ability to work in crisis conditions. Since no one has experience of working in the difficult conditions of a crisis, management skills should manifest themselves (or appear) in the process of the crisis itself. This won't happen to everyone. But the owner or manager must create conditions for the personnel that will allow the employees to understand for themselves whether their abilities and skills correspond to the tasks set. This can be done by creating a motivational system that minimizes the fixed part of the reward and fundamentally increases the variable part, which will be determined by the achieved result. Under such conditions, incapable workers will leave on their own, as they will not be able to solve their goals and earn decent money. This approach can be formalized using KPIs, which quantitatively describe the task assigned to the employee. The technology for determining the variable part is described using fig. 5.

Rice. 5.

As follows from the diagram of the figure, if the employee reaches the planned KPI value, he receives the planned reward. The amount of remuneration decreases proportionally with a decrease in the actually achieved KPI and becomes zero if the achieved KPI becomes less than a certain minimum value (point min in the figure). If the actually achieved KPI becomes higher than the planned value, then the premium increases, but not indefinitely, but up to a certain number (max point in the figure). The last feature of this algorithm insures the manager against understating the planned KPI value. During a crisis, the whole picture shifts to the right, setting higher goals for the employee and allowing him to earn more. If in such a situation the permanent part of earnings is made very small, for example, at the level of the living wage accepted in the country, the worker will be forced to do everything possible and impossible to survive. And it again resembles a cow in a bomb bay.

The listed approaches are a motivational technology for individual managers, a kind of bonus tool. If the owner and manager thinks strategically, he must understand that this tool alone is not enough. He must analyze not only the current problems and how the company will live after the crisis. A strategically thinking leader must understand that he alone is not able to bring the company out of the crisis. To work in a crisis, having or building a team is critical. Only a strong team is able not only to withstand the crisis, but also to gain new advantages. You need to analyze who is on your team. What features and personal traits are characteristic of team members, and what tasks they solve.

Vladimir Savchuk Chapter from the book "Strategy + Finance: Basic Knowledge for a Manager"

Publishing house "BINOM, Laboratory of Knowledge"

A lot has already been written about the crisis, its causes, negative manifestations and ways to overcome it. Among the recommendations there are many that deserve attention and can be used in real practice. But it is very important to understand that the main condition for any successful work is consistency, which in a crisis becomes a critical attribute of business management. An attempt is made below to systematically present all anti-crisis measures. The system is shown in fig. 1, it has the shape of a fish, which is called the Isshikawa diagram.

Rice. 1. System of anti-crisis measures

Let us give a brief description of each of the factors shown in the general diagram. All of the following is an attempt to systematically integrate an integral set of anti-crisis management measures. This does not mean that all measures must be taken. After reviewing the contents of this paragraph, the manager himself must choose what suits him best and on what he should concentrate his efforts.

Strategy adjustment. As you know, the fish begins to deteriorate from the head. Therefore, it is necessary to start by adjusting the strategy. Leaving the company's mission unchanged, its vision should be reconsidered, refusing, apparently for a while, from achieving large ambitious goals. Although the conditions of the crisis may provoke the emergence of new ambitious goals, for example, in terms of capturing the market of bankrupt companies or acquiring weaker companies that have little chance of survival. It must be remembered that the crisis creates additional conditions for development, if you correctly use the emerging opportunities.

Reconsider your attitude to the crisis based on the following positive factors:

- The crisis stimulates consolidation:

- cheapening of assets will lead to the fact that the weak will die, the strong will become even stronger,

- consolidation will most likely occur in the retail of food and household goods, banks, pharmacies, etc.

4. Several “soap bubbles” are “blown away”, in particular stock, real estate, oil, metals ...

5. The position of strong domestic players may be strengthened by a possible reduction in competition from imports and additional export opportunities.

The listed factors are named here rather conditionally. They will be positive for those who can dispose of them. And this may be the new strategy of the company.

Productivity increase. In times of crisis, the decisive factor in maintaining the performance of the company is speed. It turns out that the well-known formula of general relativity works in business: E=mc2 , however, with some amendments. E is the performance (performance) of the business, m is the mass (volume) of the resource used, and c - the rate at which this resource is used. The whole point here is that the speed is taken in the square, i.e. has an order of magnitude greater impact than the amount of resource used. In the period leading up to the crisis, most of the company, to put it mildly, "relaxed somewhat." The main focus was on mass m , and not at speed: a large “back office” staff was hired, the salaries of key specialists were constantly growing, realizing their importance, key specialists demanded comfortable conditions (expensive personal cars), hospitality expenses were constantly growing, expensive offices were built or rented. This list could be continued. Things got to the point that young graduates of the capital's universities demanded a starting salary of $1,000. At the same time, no one thought about speed.

The crisis came and put everything in its place. There was a rapid reassessment of values. The question was posed point-blank: “Gentlemen, highly paid managers, if you were not able to foresee the crisis and now you cannot overcome its consequences, then why do you receive high remuneration and why do business need you at all. Either turn on the high speed of your activity, or - goodbye, just goodbye, and not goodbye. Only those who can effectively work will remain. But being efficient doesn't mean running fast around the office. It is necessary to quickly and in detail analyze all factors of business productivity growth, if possible, excluding all activities that do not bring value to business processes. This refers to both technological and operational processes. In most cases, it is quite difficult to increase the speed of technological processes, as quality may suffer. At the same time, most organizational processes have huge reserves of acceleration. And here it is not necessary to thoughtlessly reduce staff, saving costs. Usually on the contrary, in order to increase productivity, additional costs must be incurred. At one enterprise well known to the author for the overhaul of gas wells, instead of one operator, at a certain stage of the technological cycle, they began to use two, i.e. increased costs. As a result, equipment downtime has been reduced to zero, and the rate of well workover has increased. And speed, as Einstein's formula says, is squared. In combination with other similar techniques, the amount of work performed by one team during its shift has increased. In the end, it became possible to reduce one of the five permanent teams altogether, without losing the overall turnover. The company's profit increased sharply due to the reduction of fixed costs.

This recipe is not universal - it is useful when production has a large amount of fixed overhead. As the ancient sages said, truth is always concrete. In each case, it is necessary to find those ways of improving productivity that are acceptable for a particular business. And no one, except for the specialists working at the enterprise, can do it better. True, certain tools can be recommended to these specialists.

One such tool is the Theory of Constraints (TOC) proposed by E. Goldratt. Note that this is an integral system of technologies, which in its essence reproduces the model of the weakest link, well known in technology. Suppose we want to strengthen the chain (improve the system). Where would it be most logical to focus your efforts? On the weakest link! Is it worth reinforcing something else, something that is not a limitation? Of course not. The weakest link in the chain will still break, no matter how we strengthen the rest. In other words, the effort put into the constraints will not cause immediate and noticeable improvements in the performance of the system.

Goldratt developed his approach to continuous improvement and called it The Theory of Constraints (TOC). He even described it in the novels "The Goal" (The Goal) and "Goal 2: It's not Luck" (It's not Luck!), which demonstrates the use of TOC technology. that will allow the fastest possible transformation of the entire system.

Step 1. Find the system limit. Which element of the system contains the weakest link? Is it physical or organizational in nature?

Step 2. Weaken the influence of the system limitation. In other words, to answer the question: “How to squeeze the maximum out of the limiting element without significant additional costs and thereby weaken the negative impact of the restriction on the operation of the entire system?”

Step 3. Focus all efforts on the system limiter. Once the constraint has been found (Step 1) and a decision has been made on what to do with it (Step 2), we tune the entire system so that the constraint works as efficiently as possible. We may have to slow down some parts of the system and speed up others. Then we will analyze the results of our actions: find out if this limitation is still delaying the operation of the entire system? If not, we get rid of it and proceed to step 5. If yes, then the constraint still exists and we proceed to step 4.

Step 4. Remove the restriction. If steps 2 and 3 are not enough to eliminate the restriction, then more drastic measures are needed. At this stage, some investment of time, effort, money and other resources may be required, so we must be sure that there is no way to get rid of the restriction in the first three steps. Removing the restriction implies that we will resort to any measures to remove this restriction. As a result, the limiting element will definitely be removed.

Step 5. Return to the first step, remembering the inertia of thinking. If the restriction is lifted in steps 3 or 4, we must go back to step 1 and start the cycle again. Our task is to determine the next element that constrains the operation of the system.

The five guiding steps are directly related to the three questions about change: 1) what to change, 2) what to change for, 3) how to effect the change. To understand what exactly to change, we are looking for a constraint (step 1). To figure out what changes are needed, we decide how best to loosen the limiter. We subordinate the operation of the entire system to our decision (steps 2 and 3). If this does not help, increase the bandwidth of the weak link and completely remove the restriction (step 4). In steps 3 and 4, we also flesh out "how to make change."

But, as before, "truth is always concrete." No one can point out the limitation of the system better than the experts working in the enterprise. So the challenge is, using the above formal procedure, to find a way to increase productivity by focusing on the weakest link.

The current reality tree starts with the present adverse events (ADEs) in the system and helps you get to the root cause or the single key issue that caused all the adverse events. The key problem is usually the constraint that gets "handled" using the above five-step procedure.

If the current situation, which is described using the current reality tree, does not suit the company's management, they resort to building the so-called future reality tree, which is built according to the same rules. This tool serves two purposes: firstly, it allows us to make sure that the action that the management team is about to take will actually lead to the desired results, and secondly, this diagram makes it possible to determine what negative consequences the action we have planned can cause. This allows you to logically "test" the effectiveness of the proposed actions before spending time, effort or resources on them. In this way, the worsening of the situation can be avoided.

Finally, when the decision on the course of action is made, another tree appears, namely the transition tree, which helps to implement this decision. It defines what can hinder the actions of the management team and how best to overcome these obstacles. It also allows you to set the sequence of actions necessary to achieve the goal. This diagram half answers the question "how to make change?"

The effectiveness of the mentioned tools is in their graphic clarity (in combination with the tree construction algorithm). Indeed, often the problem that the management team must solve does not have an unambiguous interpretation. Then it's worth getting together and modeling using graphical diagrams: 1) what is happening and why we are not satisfied with it (for example, insufficient performance), 2) what should be and 3) how to achieve this. The theory of constraints can serve as a convenient assistant for this.

Changing attitudes towards marketing. The fears of all marketing agencies in a crisis are justified in the fact that "now all companies will start cutting marketing budgets." Indeed, this is really observed during a crisis: being in a panic, companies begin to reduce what they can temporarily do without. This is, first of all, the cost of training and promotion of products on the market. Such measures look justified only at some, perhaps the very initial stage of the development of the crisis. If this strategy continues in the future, the company may simply lose its competitive advantage. The staff will not be able to solve the tasks that management sets for them, and the market will gradually forget about these competitive advantages.

Basically, there are two alternative attitudes towards marketing in a company.

Alternative 1. Marketing is the policy of consumers within the company, forcing the company to smoothly change in the direction desired by the majority of consumers. Companies address consumers in the market like this:

- "We will give you everything you want if you become our loyal customers."

- "We are ready to spend a lot of money, if only you were our customers."

Alternative 2. Marketing must be profitable. In other words, marketing must measure the costs of promoting products with the result that is obtained as a result of numerous marketing programs in terms of understandable economic indicators, such as profit, cash flow, etc.

In a crisis, a shift will occur in the direction of the second alternative. But it can be achieved in different ways. The owner and management of the company can take the first, radical path. It's easy to cut down on the company's marketing staff as much as possible while slashing the budgets of all marketing programs. The problem asks whether there will be an economic effect from this. Undoubtedly yes! The reduction in total costs caused by such a reduction will lead to an increase in profits and cash flow: “Thanks to marketing, it helped us save costs, and, as you know, money saved is wage money.”

The second path within the framework of the profitable marketing alternative involves conscious behavior: 1) we soberly assess the situation, 2) we are looking for new opportunities. What is the first thing to evaluate? Most companies produce several types of products and offer them in different markets. One operating unit can serve several markets at once, with different perspectives. Different operating units may operate in the same demand area. So how many lines of business does the company actually have? Why is it important. The well-known 80/20 rule works here: 80% of the results of any activity are provided by 20% of the efforts. In a crisis, a company cannot afford to scatter resources on non-core (non-profitable) activities. First of all, it is worth focusing the attention of marketers on promising products and activities, focusing all marketing costs on this segment.

There is another focus of preference. The totality of all marketing activities is divided into two areas: let's call them a short and a long wave of the value (performance) of marketing programs. Short wave marketing activity involves a quick market response to the marketing costs incurred. The "long wave" should provide a lasting effect, aimed primarily at strengthening the strength of the brand. From the point of view of financial management and management accounting, the money spent for the "short wave" is directly included in the costs of the period in which they are incurred. And the result should be an increase in operating profit, i.е. EBITDA. In the case of a "long wave", the costs incurred should be expected to pay off over a longer period, perhaps a year or two. From the point of view of financial management, cash flow will decrease significantly, but operating profit may increase. This will happen due to the fact that not all the money spent on marketing will be included in the costs of the period, but only some of it. Sales growth can offset this portion of the extra cost of the period so that profits can increase.

In a crisis, preference for marketing activities should be focused on the "short wave". And not only because there are no sufficient funds for this. In a crisis, the situation changes very often, and it is impossible to predict many manifestations of the crisis. To a greater extent, this applies to long-term forecasts. It is clear that investing in long-term marketing programs seems dubious - money can be spent in vain ...

Management of economic factors. The main manifestation of the crisis from which business suffers is the lack of money. On fig. 2 is a diagram explaining the causes and manifestation of lack of money.

Rice. 2. Reasons and indicators explaining the lack of money

So, there are only three main reasons: 1) the company does not manage to sell a lot, 2) the company incurs high costs, 3) the company does not know how to manage working capital. These three reasons may not appear in standard, non-crisis circumstances, but in crisis conditions they arose due to the unwillingness of management to reorganize to work in new conditions. Worst of all, when all three causes appear at the same time, which most often happens. As you can see from the diagram, the indicators that signal to management that a problem has arisen are profit and cash flow. What should the management team focus on first in order to at least reduce the impact of the lack of money problem - on profits or on cash flow. Profit is a necessary but not sufficient condition for obtaining money. In other words, to ensure the company's ability to generate money, it must make a profit. In standard, non-crisis conditions, this condition is considered unshakable. But in a crisis, you need to generate money in any way, and do it quickly. What happens during a crisis? Sales are falling. This is a deep reason. It is not possible to fix it quickly - the markets are shrinking. Partial compensation for the drop in sales may occur due to cost reduction. This is what companies “know how” to do best. But it is not a fact that cost reduction will not lead to more about a greater drop in sales, which will eventually lead to more about more losses. We discussed this possibility when analyzing marketing aspects.

During a crisis, a company needs time to restructure its activities in relation to crisis conditions: shrink, cut some activities, optimize staff. After such a restructuring, the company will learn to live in a new way and make a profit, most likely in smaller volumes, but adequate to shrinking markets. During this restructuring, the company will not be able to live without money. Therefore, money must be made or saved at any cost. So, from the two indicators of the scheme in Fig. 2 more important is the indicator of operating cash flow, rather than profit, at least in the initial stages of the crisis.

And here comes the technology of Total Money Management, or TCM, from the English term Total Cash Management. The essence of TCM is manifested in the practical implementation of the following two fundamental provisions:

1) all aspects of the enterprise's activities must involve available or fundamentally available financial resources,

2) each employee of the enterprise can influence the state of financial resources by applying some simple rules every day.

In many real situations, managers of enterprises in the course of their activities do not realize the exceptional importance of money. They do not understand that money is a completely liquid asset. Having money, an enterprise can solve absolutely all problems, both technological, and marketing, and all the rest. This is especially acute in times of crisis. The pragmatic goal of TCM is to create a system that:

- on the one hand, it contributes to the efficient generation of cash flows,

- on the other hand, it contributes to their no less effective use, again with the aim of generating subsequent cash flows.

It is important to understand that TCM does not consist of "Save Money" slogans alone that must be posted throughout the firm in order to succeed. This is far from the case: TCM is, first of all, a system that covers all the activities of the company. The figure shows the main blocks of TCM.

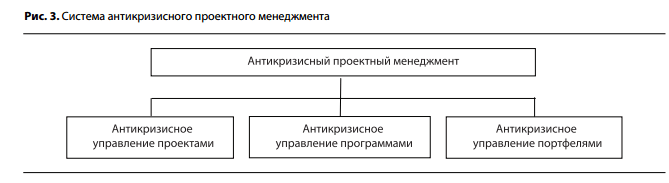

Rice. 3. The structure of the total money management system

The systemic nature of the TCM concept is manifested not only in the fact that each functional unit and even each person plays a role in the implementation of strategic goals, but also in the fact that an additional effect can be created at the junction between units. In other words, improvements in one of the blocks shown in the figure may cause changes in other blocks so that the cumulative effect may be either greater or less than the sum of the two individual effects.

Our next task is to give a brief description of each individual block.

Money management in marketing. In a complex business system, marketing and sales services are rightfully considered the first among equals because they bring in money. We list the main tasks and problem areas of using TCM in marketing:

- discounts depending on the volume of sales of finished products;

- discounts depending on the terms of payment for shipped products;

- inventory volume as a competitive marketing tool;

- provision of risky commodity loans;

- time management of sales to equalize production volumes;

- increasing sales with the help of TCM;

- creating an adequate reaction of competitors.

Let us dwell on some provisions, considering most of them obvious.

First of all, we note that here and below the provisions listed are more likely to be problematic areas, i.e. an indication of a set of issues that are implied to be solved, and not final technologies. In particular, speaking of discounts depending on the volume of sales and terms of payment for shipped products, we emphasize that this issue should not be left to chance. It is necessary to develop a technology for estimating the allowable size of the discount according to the criterion of the maximum final cash flow, to test it in the course of practical activities and then make it an internal standard.

"The volume of stocks as a competitive property of marketing" is manifested in particular in the fact that the desire to fully satisfy the needs of customers, enterprises invariably increase the volume of stocks. At the same time, this “freezes” money, which can lead to a shortage of money and the inability to make another profitable purchase of goods, which is designed to replenish stocks. It is clear that some optimum must be found.

Consider another rather “subtle” problematic issue from the list above: “creating an adequate reaction of competitors for our company”. An adequate reaction here is understood as a competitor's panic in connection with the actions of a firm practicing SCI. Let the main competitor does not follow TCM. This means that he measures the effectiveness of his activities using a monthly or quarterly income statement. Our company is starting to make a price discount on the market, while reducing the period of deferred payment. It is clear that the turnover of money in this case increases, although the net (accrued) profit falls. The competitor is also forced to make price discounts. But since the criterion for him is the profit for the month, he is naturally in a panic, as the profit falls. A competitor can do a lot of stupid things, for example, inadequately reduce costs at the expense of salaries of managers, and thus come into a state of crisis. Our firm has peace of mind because it hasn't lost any money and doesn't need to take a pay cut for its managers.

What can be used as a technology for evaluating the effectiveness of a particular SCI technique. The answer is simple enough. The financial manager sits down at the table, turns on the computer, opens a program that simulates a monthly or quarterly budget, and starts playing with numbers, building all sorts of scenarios. Moreover, these scenarios should pursue a specific goal. In the example just considered, the goal is to choose the ratio of the price discount and the grace period in such a way as to prevent a decrease in cash flow over the analyzed period. And do not be afraid of a temporary decrease in net profit. Within TCM, this is less important. So, here, as well as in almost all similar situations, the main decision-making technology is the budgeting program, which allows you to evaluate the monetary consequences of any managerial step.

Inventory management to save money. Almost all managers complain about excess inventory and sub-optimal inventory. This is especially true in times of crisis.

Here is a list of the main problematic issues that the TCM system should solve in terms of reducing stocks:

- resolving trade-offs between inventory levels and customer service levels;

- optimization of the purchase volume of a batch of goods;

- implementation of an inventory accounting and control system that works in real time and real value;

- continuous assessment of the real value of stocks in the warehouse;

- getting rid of obsolete goods in warehouses by selling at large discounts or simply writing off;

- control of costs associated with inventory;

- optimization of the volume of spare parts for production equipment;

- optimization of the product range in terms of inventory reduction.

The fact is that stocks fundamentally tend to grow. This is the law of business. But this growth can only be justified by an adequate increase in sales volumes so that inventory turnover does not decrease.

Collection of receivables. This type of activity is a thankless job. In a crisis, the main reason for non-payments is that the client has little money - they are not enough to fulfill all obligations. Considering overdue debt from a financial point of view, it should be emphasized that for the client it is a significant source of financial resources, especially in conditions of high interest rates. Therefore, the client will adhere to this rule with all his might. The main task of TCM in terms of ensuring the collection of receivables is to carefully analyze all clients and find out the reasons for late payment of the company's bills.

We list the main problematic issues of collecting receivables:

- systematization and analysis of information on all clients of the company, including potential customers;

- establishment of a system of discounts in case of early payment of company bills;

- development of a system of legal measures to “intimidate” unscrupulous clients;

- filing applications with the arbitration court to declare the client bankrupt;

- the use of factoring in order to obtain a part of receivables outstanding on time;

- introduction of a system of responsibility of sales managers for late payment of company invoices by their clients;

- refusal to serve clients who are weak in terms of money.

An important of the factors listed above is the personal responsibility of managers for debt collection. This responsibility should be shared between account managers and sales managers. The former are responsible for the timely delivery of information that the payment period has expired. The latter manage the work and are directly involved in the collection of receivables.

Day to day money management. TCM is a permanent process. But the most constant of all the SCI blocks is the daily routine of money management. This is the prerogative of the financial director, who instructs the accounting department to transfer money to the appropriate account of a counterparty. The importance of a balanced day to day money management cannot be overestimated. Distortions in one (aggressive) or other (sluggish, inert) direction can cause negative consequences for the company as a whole.

Below are the main tasks and problematic issues that represent the content of everyday money management:

- operational budgeting of daily payments;

- daily cash reports;

- rational repayment of accounts payable;

- payment of wages and other remuneration to employees;

- reimbursement of expenses (travel, representation, etc.);

- use of the electronic transfer system;

- use of credit cards.

In the process of establishing day-to-day money management, it is important to observe two principles:

1) at the beginning of each day it is necessary to know exactly who and for what will have to pay, and at the end of each day it is no less firm to know to whom and for what the money was actually paid;

2) try to avoid making transactions with cash.

The operational daily budget is not detailed and exhaustive. This is a budget for cash payments only, which compares all cash receipts and payments that are planned for the current day.

Speaking about the system of repayment of accounts payable, it should be understood that the true art of financial management of accounts payable is to select the "right" creditor and pay him, and delay the "wrong" creditor for a while, and maybe not pay him at all . Such activity from the standpoint of the TCM is not contrary to its basic principles. It would be strange to expect TCM to be based on biblical principles.

Now let's briefly dwell on the second principle of everyday money management - avoiding the use of cash whenever possible. It seems that this principle is obvious, unless, of course, we keep in mind the tasks that an enterprise sets itself, at least partially operating “in the shadows”. Many domestic enterprises, especially from the category of large ones, are gradually switching to paying wages using deposit cards. Banks strongly recommend corporate deposit and credit cards for reimbursement of hospitality and travel expenses. The use of the "card" settlement system allows you to significantly save time and effort of employees in the process of daily money management.

Choosing a bank and working with it. There are two complementary goals in working with a bank (or banks). The first goal is to provide ourselves with the necessary quality and qualified service. In this regard, the company must choose a bank for itself, the service of which would meet its requirements in terms of convenience. The second goal is the constancy of access to short-term loans. There is a famous joke: banks are always ready to lend you money, except when you really need it. In modern conditions of general distrust (the bank to the client, and the client to the bank), it is quite difficult to expect to have a permanent source of credit to cover the short-term budget deficit. This is especially evident in times of crisis. In the system of work with banks within the TCM, the following problem areas can be considered:

- establishing the criteria by which a bank is selected;

- constant monitoring of the state of the bank, in order to detect possible negative aspects of its activities, for example, a decrease in liquidity;

- reducing the cost of banking services;

- conducting periodic reconciliations of bank accounts;

- obtaining a credit line and maintaining it.

Despite the versatility of the relationship between the firm and the bank, the main purpose of the TCM system is to cover the temporary shortage of money, as well as the search for a successful placement of temporarily free cash.

Cost management and control. It is cost management, and not cost reduction, that is the content of TCM. According to their behavior, costs are divided into variable and fixed. The former change in proportion to the change in sales volume, the latter remain unchanged. In a crisis, everyone rushes to urgently reduce costs. These are fixed costs that do not depend on the volume of production and sales. And this is justified, since in a crisis, when sales are falling, fixed costs are “dead weight” on the enterprise. Variable costs (the cost of raw materials, process energy, direct piecework) automatically decrease as sales decrease.

Reducing fixed costs should be treated selectively. Do not thoughtlessly cut costs. Laying off house cleaners and switching to cheaper toilet paper for the office won't save the business. In a panic, company management typically makes two mistakes:

Small but noticeable items of expenditure are reduced, for example, of a fashioning nature, which immediately sends a negative signal to the market about the state of the company.

Thoughtless cost control can be detrimental to the business itself, in particular, the dismissal of key employees can lead to a loss in the quality of products or services.

One of the measures to reduce costs can be the conversion of some fixed costs into variables. Specifically, this can manifest itself in two cases. The first is related to the transfer of payment for managers' remuneration, mainly depending on the result obtained, as they say, success fee. Instead of dismissing the manager, which objectively reduces costs, he is given an insignificant fixed part of the salary (fixed fee), and the rest of his remuneration will depend on the result he receives. We will develop this topic at the end of this paragraph, when we talk about megamotivation.

The second way to convert fixed costs into variables is through outsourcing. This can be done in many areas of companies. Let's give just one example. Many domestic manufacturers and distributors of consumer goods have their own resources to promote their products. In standard times, this was considered a manifestation of the strength of the company. In conditions of contracting markets, this becomes unprofitable. Here you can use the services of specialized marketing agencies. At the same time, it becomes costly for marketing agencies to have logistics units that provide them with the storage and distribution of goods in the system necessary for promotional campaigns. Distribution companies with strong logistics capabilities could approach marketing agencies to actively outsource their logistics. As a result, the necessary functions will be performed on both sides, and the amount of the resource involved will decrease.

If the question is correctly posed, it should be about profit management mechanisms, including through cost reduction, rather than cost reduction as an end in itself.

Transformation of investment and financial activities. It is generally accepted that during a crisis, investment activity should be reduced. Real practice proves this, judging by the numerous reports of the suspension or termination of the construction of new production facilities, the cancellation of earlier decisions on investment. The reduction in investment activity is due to the fact that 1) there is simply not enough funds, 2) the prospects for new investment projects are unclear.

At the same time, the crisis provides an opportunity to increase the company's assets and expand the scope of its activities through the acquisition of other weaker enterprises. There is no doubt that in a period of crisis there is a redistribution of property - the strong absorb the weak.

So, the transformation of investment activity should be considered from two positions:

1) developing an attitude towards investment decisions made before the crisis,

2) analysis of opportunities to increase investment activity by acquiring new assets, using a probable decrease in their price.

In a crisis, the procedures and technologies used for conducting the investment activity itself should be reviewed. Here are typical features of the investment activity of domestic companies:

- The task of investment development, which is important for business, is solved through outsourcing (assigned to a consulting company).

- Closed software products are used that do not provide a transparent idea of the business for the owner and management.

- The focus is on cash flow forecasting and calculation of standard indicators (NPV, IRR, DPB) without deep insight into the practical economics of the project. At the same time, the choice of the discount rate does not correspond to the specifics of project financing.

- Investment analysis lasts for 2-4 months and ends with a rather cumbersome description containing many unnecessary details.

- It is often not possible to trace a direct link between a business idea and/or technological improvement and the economics of the project.

In a crisis, this is not good. The main task of investment design in a crisis environment is as follows :

We do it for ourselves, quickly and without errors.

So, as before, the speed and quality of decisions made . Agree that there is nothing simpler than making a decision to buy companies that are rapidly losing their effectiveness, as a result of which their owners are ready to sell them cheaply. And then what? Resell to someone for a higher price. This is what so-called portfolio investors usually do. It is not certain that this speculative operation will be successful. So, you need to buy, following the strategic goals. During the crisis, the takeover of weak companies will be carried out mainly by a strategic investor. The latter, by definition, will seek to develop the purchased object in order to earn even more money on it.

The strategic investor has two problems. First, you need to act quickly, otherwise another strategic investor will get ahead. Secondly, you cannot make a wrong decision, otherwise the money spent will not be returned. To minimize the risks of these two mistakes, the investment technologies used must meet the following requirements:

- The technology must allow quick and correct conclusions about the feasibility of investments.

- Technology must be flexible , i.e. able to make multiple recalculations depending on changing conditions.

- Technology must be individual , i.e. reflect the features of the existing business and the special requests of the owners and top management.

- Technology must be open and transparent : the occurrence of each indicator must be traced ( widely used Project Expert does not meet this requirement).

- Technology must be as clear as possible for a possible potential investor : it is enough to show justify marketing forecasts and show financial tables, and the investor is ready to make a decision.

If a company owns such technology, it is able to avoid these mistakes. Otherwise, enterprises with a negative economic result will be bought and resold.

What about already launched investment projects. In principle, three outcomes are possible: 1) stop, 2) suspend, 3) continue. In each outcome, all possible consequences should be calculated. The first decision is the most painful for the business and for the owner. In essence, the money spent has every chance of not being returned, but if an unpromising project is continued, then some more amount of money will be wasted, i.e. losses will increase. Of two evils, usually choose the lesser. The second outcome essentially postpones the moment of making a decision, the owner temporarily calms down and is satisfied that some part investment money will be spent in the near (or far) future, and now you can save on it, providing current liquidity. Finally, the third solution is the most daring and, perhaps, desperate. Despite everything, the company continues the investment project. The adoption of such a decision should take place outside the emotional plane. It is necessary to thoroughly calculate the changed market prospects and analyze the risks investment project in changed conditions.

Financial activities companies in a crisis occurs in the most stressful conditions. In essence, all enterprises are moving to a starvation financial ration. This primarily concerns credit sources of financing. At the initial stages of the crisis, the banking system decides to limit or completely eliminate lending. Banks, as you know, have two sources of income: 1) through active lending operations and 2) trade and commission income, which is obtained as a result of interbank sales / purchases of financial resources and numerous commissions for the services they provide to their customers. So the banks decide: no new loans and continuation of old loans, focus on trade and commission income, with which we will cover our reduced operating costs (banks also reduce their fixed costs). In other words, banks are completely giving up profits in an attempt to maintain their liquidity.

This situation cannot continue for a long time - the rejection of profit means, in essence, the rejection of business. After partial restoration of the financial system, banks will resume lending. The problem asks which enterprises will be able to become their clients for lending in the first place? Now many are thinking about those industries that will be less affected during the crisis. It turns out that such industries, in fact, do not exist. Banks will become more selective in finding clients for lending. As selection criteria, banks will take into account not the solidity of the client (the crisis showed that solid clients go bankrupt in the first place) and not collateral (it will be impossible to sell the property of a bankrupt borrower), but the company's ability to withstand the crisis. With regard to the content of this paragraph, the ability of an enterprise to obtain a loan will be determined by its ability to implement the program presented in Fig. 1. Credit expertise of banks will become more focused on the analysis of the real economy of borrowing enterprises, rather than formal financial indicators. In other words, the prospects for financial performance of companies in a crisis will be determined by their ability to withstand the devastating effects of the crisis.

Having problems with money, the head of the company should not “write off” all of them for the crisis. A crisis, even an external one, actually reveals the company's hidden problems. There are three groups of reasons that lead the company to a shortage of money. The first group includes market reasons, which can be both external and internal. These are, first of all, a drop in sales volumes and shortcomings in assortment management. Indeed, sales volumes may fall due to an external cause, i.e. due to market shrinkage, or may be the result of an imperfect marketing strategy of the company. Even if markets shrink, the marketing strategy must find a way to maintain volume. Among the internal causes of the shortage of money is the imperfection of the financial management system, which manifests itself in

Lack of management accounting

Weak financial planning

Low qualification of financial managers,

Suboptimal financial management structure,

Loss of control over costs.

The external causes of the shortage of money include:

- nonpayment crisis,

- competition from other manufacturers,

- rising energy prices,

- export losses due to an undervalued exchange rate,

- losses from imports due to an overvalued exchange rate,

- tax pressure,

- high cost of borrowing,

- inflation pressure.

The emerging external crisis should reveal all internal causes, increasing the perfection of all aspects of the company's activities, in the face of objectively existing external causes.

What to do to reduce the shortage of money. First of all, one should not succumb to panic and systematically present the directions in which it is necessary to act. The system of measures presented in fig. 4 looks very simple.

Fig.4. System of measures to reduce the shortage of money

Having built a kind of Procrustean bed of the system, it is necessary to think through the possible ways in detail. These measures will vary from company to company. Below is a list of the most typical measures for each of the groups.

1. Short-term measures to increase the inflow of money:

Sale or lease of non-current assets,

Rationalization of the product range,

Restructuring of receivables into financial instruments,

Using partial prepayment,

Development of a system of discounts for buyers,

Attraction of credit sources of short-term financing.

2. Short-term measures to reduce the outflow of money:

Cost reduction,

Postponement of payments on obligations,

Using supplier discounts,

Revision of the investment program,

tax planning,

Bill settlements and offsets.

3. Long-term measures to increase the flow of money:

Additional issue of shares and bonds,

Company restructuring - liquidation or separation into separate business units,

Search for a strategic investor,

Search for a portfolio investor.

4. Long-term measures to reduce the outflow of money: