Is it possible to get a tax deduction for ultrasound? Tax return information. Reasons for refusal to receive a tax deduction

Maria Sokolova

Reading time: 5 minutes

A A

Every mother knows that the birth of a child is not only the joy of the appearance of a long-awaited baby, but also very significant expenses, which should, first of all, include paid pregnancy management and paid childbirth. Not all parents are aware that part of the funds spent on the listed medical services can be legally returned to their wallet - let's figure out how to do this correctly.

What do you need to know about the social tax deduction and how to get your money back?

What documents allow you to return the money?

While preparing for motherhood, the expectant mother should study in more detail the information about her rights, which includes tax deductions - that is, income tax refund . In more understandable terms, this deduction implies the return from the state to the taxpayer of part of the funds (13%) that were spent on services available in list approved by the Government of the Russian Federation (resolution dated March 19, 2001 N 201).

Tax deduction can be returned for payment for pregnancy and childbirth, as well as for any examinations within this framework, tests, ultrasound examinations etc.

However, you must remember: You will be paid no more than what was paid in tax in the reporting year.

Example: If you earned 100 thousand in 2009, paid 13% tax, that is, 13 thousand, then no more than 13 thousand will be returned to you.

There is also a limit on the total amount spent on treatment and training - it is no more than 13% of 120 thousand rubles currently (that is, you can get back no more than 15,600 rubles).

However - this does not apply to expensive treatment- for example, in case of complicated pregnancy, complicated childbirth, caesarean section. For expensive treatment You can get a refund for the entire amount , and therefore it makes sense to look at the list of expensive medical services eligible for tax payments, for example, on the Internet.

Considering that this list includes most of all treatment and examination options , the expectant mother should not ignore this opportunity. But only those mothers who can confirm with documentation the fact of paid pregnancy and paid childbirth .

You have the right to a deduction for pregnancy management in a paid clinic, paid childbirth under an agreement with an insurance company, if...

- You are a citizen of the Russian Federation.

- We used services in clinics in the Russian Federation.

- They spent their personal funds when concluding/renewing a DMO agreement that provided for insurance payments.

- They used expensive medical services during pregnancy and childbirth.

- Your annual income is less than 2 million rubles.

Please note - about restrictions on the return of deductions

You cannot receive a deduction if...

- The funds went towards the service concluding/extending a DMO agreement that does not provide for insurance payments .

- Pregnancy management and paid childbirth were carried out outside the Russian Federation .

Part of the funds is returned only in cases where if services for paid pregnancy and paid childbirth were provided by a licensed institution. Therefore, do not forget in the process of concluding an agreement with the clinic to make sure that the license is available, as well as its expiration date. The ideal option is to immediately ask a clinic employee for a copy of the license.

How to return income tax for paid services for pregnancy or childbirth - instructions

For your information - part of the amount (for example, for paid childbirth) can be issued to the spouse- if, of course, he worked and paid taxes. To file part of the tax payments for a spouse, you need to take a certificate from the medical institution that provided paid services, where he will be indicated as the payer, and also file an income declaration for the period under review for him.

Documents you will need:

- Statement to receive a deduction.

- 2-NDFL(from your accountant or from accountants if you worked in different places during the year) and 3-NDFL(annual declaration).

- Official agreement with the clinic whose specialists provided paid pregnancy care or paid childbirth care (copy) + copy of the clinic’s license. Memo: they have no right to demand a copy of the license if the certificate for the tax authorities contains the clinic’s license number.

- Payment document(original only), certificate of expenses incurred (issued by the clinic that provided paid services for pregnancy and childbirth).

- Copies of documents of next of kin(if you file a deduction for them) – birth certificate, marriage certificate, etc. + notarized power of attorney from a relative.

pay attention to code in the certificate from the clinic. During normal childbirth they place code 01, in case of complications (in particular, caesarean section) - 02 .

Obtaining a tax deduction for the paid services provided to you for pregnancy and childbirth involves several steps that are not particularly difficult.

Instructions:

- Prepare all documents, including details of the bank account to which the money should be received.

- Certify all copies necessary documents for the tax authority.

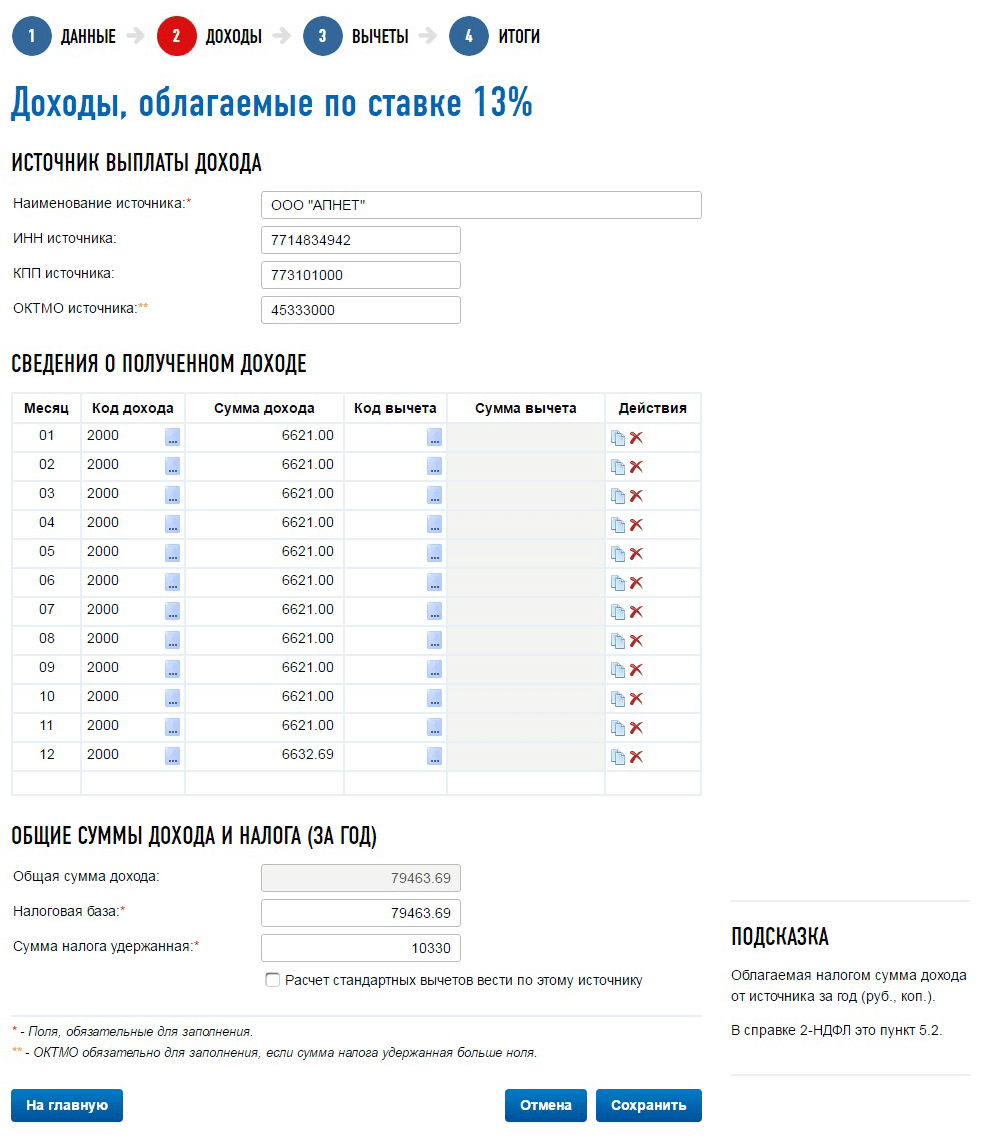

- Fill out your tax return(Form 3-NDFL) based on your documents.

- To write an application for a tax refund for paid childbirth and paid pregnancy management.

- Complete documents to receive a deduction for samples.

- Submit all documents to the tax authority at the place of registration. The first option is to submit the package of documents in person (the most reliable way) or with a notarized power of attorney (if you are applying for a deduction for a relative). The second option is to send a package of documents by mail to your tax office (with 2 copies of the list of attachments, with a list of all documents, and a valuable letter).

- Wait for the test result according to your application.

- Get money.

What else do you need to remember?

- License. An insurance company (clinic, maternity hospital) that provides paid services for pregnancy and childbirth must be licensed.

- The amount of the deduction. This is an individual question. It will depend on the amount you spent on paid pregnancy management and paid childbirth in the chosen clinic.

- Receiving a deduction - when to apply? The declaration is submitted in the year following the year of direct payment for the service (for example, paid in 2014 - submitted in 2015). A deduction not completed on time can be issued later, but only for the previous 3 years (for example, in 2014 you can return it for 2013, 2012 and 2011).

- Receiving a deduction - how long will you have to wait? Document verification is carried out within 2-4 months. Based on the results of the inspection, the applicant is sent a notification of its results within 10 days (refusal or provision of a deduction to your account). Remember that you may be called to clarify questions that have arisen (doubts about the authenticity of documents or copies, missing papers, etc.), so prepare the documents carefully (save your time).

- If you are not given a certificate from a clinic or maternity hospital that provides paid services for pregnancy and childbirth, contact the head physician, the court or the health department. You can request this document not only immediately after the service is provided (for example, upon discharge from the maternity hospital), but also at any time within 3 years after the service is provided (at your request).

During the year, as an individual, I visited a private clinic (appointment with a doctor, tests, ultrasound, medications). To take advantage of the social deduction, you need to submit 3 personal income taxes. For what medications and honey? services can be deducted. And what documents need to be attached to the declaration.

list approved

Clause 2 of the List of Medical Services stipulates that it includes services for diagnosis, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practice doctors), including medical examination.

On the issue concerning the classification of specific medical services as types of services included in this List, it is necessary to be guided by the All-Russian Classifier of Types of Economic Activities, Products and Services OK 004-93, approved by Resolution of the State Standard of Russia dated 06.08.1993 N 17.

According to the All-Russian Classifier of Economic Activities, Products and Services, laboratory testing services are included in outpatient treatment services provided by clinics (code 8512000 “Outpatient treatment services provided by clinics and private medical practices” includes code 8512400 “Laboratory tests provided by in clinics").

Consequently, the costs of taking tests at the clinic are taken into account when providing a social tax deduction.

Diagnostic services include ultrasound.

Thus, you have the right to claim a deduction for ultrasound and tests; as for medications, it all depends on whether they are included in the list or not.

The rationale for this position is given below in the materials of the Glavbukh System

A person who spent money on treatment, medicines, voluntary health insurance can receive a social tax deduction (paragraph, subparagraph 3, paragraph 1, article 219 of the Tax Code of the Russian Federation).

What can you get a deduction for?

86.71338 (6,7,8,9)

Social tax deduction for treatment can be obtained:

- a list of medical services or a list of expensive types of treatment, approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201;

- when paying for medical services that are included in the list of medical services or the list of expensive types of treatment, approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201;

- when purchasing medications that are included in the list approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201;*

- when paying premiums under voluntary health insurance (VHI) agreements. And it does not matter whether medical services were provided to the citizen under such an agreement or not (letter of the Ministry of Finance of Russia dated December 10, 2014 No. 03-04-07/63495, which was communicated to the tax inspectorates by letter of the Federal Tax Service of Russia dated January 12, 2015 No. BS-4- 11/26130).

In this case, a deduction for the treatment of a husband (wife) can be obtained even if the documents related to payment for such treatment are issued in the name of the other spouse. The fact is that property (including money) acquired by people in marriage is their joint property (clause 1 of article 256 of the Civil Code of the Russian Federation, clause 1 of article 34 of the Family Code of the Russian Federation). Therefore, it does not matter which spouse has the documents (agreement with a medical organization (entrepreneur), payment documents, etc.). Such clarifications are given in the letter of the Ministry of Finance dated July 23, 2012 No. 03-04-05/7-895.*

86.71343 (6,7,8,9)

To receive a social deduction, you do not need to fill out a separate application. It is enough to submit to the tax office:

- declaration in form 3-NDFL;

- documents confirming treatment costs (medicines, health insurance).

At the same time, to confirm the data specified in it, the tax office may require the submission of certificates in Form 2-NDFL from everyone who paid income to a person during the year.

How to get money back for paid childbirth, treatment, paid tests, purchase of medicines, etc.

Our state provides a tax deduction; if you received paid treatment in medical institutions or purchased medicines, you can return the income tax you paid (13%). Unfortunately, this payment has a number of pitfalls, like all other payments () for women who have given birth.

Let's figure it out so as not to beat the thresholds of the tax authorities. Let’s take a situation where you were preparing for pregnancy, giving birth, undergoing a bunch of paid tests, ultrasounds, dental treatment, etc., i.e. routine medical services. We will not delve into expensive treatment and other exclusionary aspects of this “freebie”

So, briefly about the rules:

- Tax deductions can be returned for the previous 3 years.

Those. If you paid for treatment in 2016 (2014 or 2015), then we will submit documents for the deduction in 2017. Thus, this year is the last year for filing documents for deductions for 2014. If you were treated in 2016, then you have time until 2019, but it is better not to delay. - The tax deduction for treatment cannot exceed the amount of 120,000 rubles.

Those. the maximum amount for which you can collect documents is limited to 120,000 rubles, in your hands you will receive 13% * 120,000 = 15,600 rubles. However, you can apply for this amount every year. - Who can receive a tax deduction?

Working taxpayers, and you can receive 15,600 rubles or less only if you paid this amount in tax during the year. If for some reason you did not work or you do not have enough deductions, your closest relatives (parents, husband or wife, children) can file for you.

It is important! The year in which the payment for treatment was made is taken! And this year it looks like how much money your employer transferred to the income tax budget (about 13% of the official salary).

4. Is it possible to get a tax deduction if checks are lost?

At the discretion of the tax authority, they may refuse. So I advise you to immediately make copies of receipts (they are erased very quickly and become unusable, such cheap paint is used nowadays)

Documentation:

- Certificate of income in form 2-NDFL from each place of work (original).

Important! A certificate is required specifically for the year in which payment for treatment or medications was made - Agreement with a medical organization (copy).

- Certificate of payment for medical services (original).

- License from a medical organization (certified copy, i.e. with a blue seal)

We request points 2, 3 and 4 from the medical institution; usually they themselves know what is required by the tax authorities and it is enough to simply inform you that you need a set of documents to receive a tax deduction.

5. Payment documents (copies).

6. Prescription forms with drug prescriptions (copies)

7. Account details in Sberbank where the money will be transferred (copy)

8. If for a child - birth certificate (copy)

9. If for a spouse - marriage certificate (copy)

10. Copy of passport (main + registration)

11. TIN (copy)

12. Completed 3-NDFL declaration (original)

To fill out 3-NDFL, it is best to contact a specialist. This service will cost you 500 rubles, but you will be completely sure of the correctness of filling out and you will not have to go to the tax office one more time.

13. Application for money transfer (original)

Advice! If you want to get money for taking paid tests in laboratories such as Medlab, Helix, Citylab, etc. Keep in mind that for each procedure they issue a contract along with a receipt, I strongly recommend keeping both, since if you lose the contract they are very reluctant to restore everything, you will have to waste your nerves and time.

(Visited 420 times, 1 visits today)

Due to the fact that the tax regulation system established in Russia requires citizens of our country to receive a social tax deduction if they have incurred costs for their treatment, taxpayers have the right to return part of the funds spent on medical services. For this purpose, taxpayers have the right to submit documents to the inspectorate and receive a tax deduction for paid childbirth and pregnancy management.

Tax deduction for paid childbirth and pregnancy management: who can and cannot receive a deduction

Art. 219 of the Tax Code of the Russian Federation determines that if the taxpayer has incurred costs associated with receiving medical services, then the state must reimburse 13% of the costs incurred.

Important! Expenses for pregnancy and paid childbirth of a woman also fall into the category of services, the partial cost of which the taxpayer has the right to reimburse.

Before submitting documents to the inspectorate, it is necessary to determine whether the taxpayer belongs to the category of persons entitled to receive a deduction. Both a woman and her husband can receive a social deduction for paid childbirth and pregnancy management, provided they meet the following criteria:

Conditions for providing a tax deduction

You can receive a tax deduction for paid childbirth and pregnancy management for the following types of services:

- Medical consultation with doctors of all specialties;

- All types of body diagnostics (ultrasound, screenings, tests, etc.);

- Treatment of women during pregnancy, both inpatient and outpatient;

- Childbirth carried out on a paid basis;

- Medicines purchased according to a prescription from a supervising physician.

It should be noted that all treatment services must be provided only by medical institutions of the Russian Federation that have the appropriate license.

Deduction for expensive treatment during childbirth (caesarean section, difficult childbirth, etc.)

The procedure for filing a deduction for paid childbirth

In order to receive a tax deduction for pregnancy and paid childbirth, the recipient must collect the necessary package of documents and submit them to the Federal Tax Service inspection at the place of their registration.

Important! Even though inspectors require copies of documents from individuals, the originals should still be taken with you for confirmation.

After submitting the documents, tax authorities have three months to verify the documents for the provision of a deduction. After this period, Federal Tax Service employees send a notification with the decision made.

Required documents to receive a deduction

A spouse, wishing to receive a deduction for pregnancy and paid childbirth, must collect and submit the following documents to the inspection:

- Passport of a citizen of the Russian Federation - recipient of a tax deduction;

- Certificate of income for the past year issued by the employer;

- If the deduction will be issued to a spouse, it is necessary to confirm the marital status with a marriage certificate and the spouse’s passport;

- Declaration in form 3-NDFL;

- Agreement with a medical institution and an act on the provision of medical services;

- All payment documents confirming the costs incurred by taxpayers for pregnancy and paid childbirth;

- Details of the account to which the refund will be made.

Where to submit documents to receive a deduction

After filling out a declaration for reimbursement of monetary expenses and preparing documents, the taxpayer has the right to contact the Federal Tax Service inspectorate at the place of his registration. The law allows the following methods of providing documents to inspection employees:

| p/p | Method of submitting documents to receive a deduction | Advantages | Flaws |

| 1 | Personal visit | This method has proven itself to be the most reliable, since tax authorities often review the documents submitted by the taxpayer immediately upon delivery. In this case, if any shortcomings are detected, the Federal Tax Service employee will immediately notify the individual of the need to make corrections. | However, not every working citizen can take the time to go to the inspectorate. |

| 2 | Postal services | It makes sense to provide documents in this way only if the post office is within walking distance, and the tax office is very far away. | A significant disadvantage of such a transfer of the declaration is that if errors are identified, the taxpayer will learn about it after several months. As a result, the process of receiving a social deduction will be much longer. |

| 3 | Personal account of the Federal Tax Service | A one-time visit to the Federal Tax Service will allow you to solve many tax problems in the future without leaving your home. | Registration on the inspection website requires visiting the tax office to obtain a login and temporary password. |

| 4 | Portal "Government Services" | You can register on the Gosuslugi portal without leaving your chair by logging in using your identification document. | No deficiencies identified |

| 5 | Contacting your employer to receive a tax deduction | The employer can also become an intermediary between the taxpayer and the inspectorate when submitting documents. The advantage of contacting the company's accounting service is that the employee does not have to wait until the end of the tax period. | However, in the case when you need to receive a deduction not for the past year, but for previous periods, you can only contact the Federal Tax Service inspectorate. |

Who can get husband/wife (features)

Important! In accordance with the letter of the Ministry of Finance no.03-04-05/22028 from 05/12/14 The taxpayer has the opportunity to receive a tax deduction for pregnancy and paid childbirth, both in the name of the spouse and in the name of the spouse.

The couple has the right to determine in which situation the deduction will be maximum. The position of the Ministry of Finance also determines that the fact that the contract and act for the provision of medical services and payment documents are issued in the name of the spouse has absolutely no significance. This point of view is also confirmed by the Civil Code, which contains information about property acquired jointly during marriage, which may include the amount of money deducted for the treatment of the spouse.

Deadlines for submitting documents to the inspection

Tax deduction code for paid childbirth

Each taxpayer receiving a deduction for paid childbirth should pay attention to the deduction code, which is indicated in the certificate issued by the medical organization.

If the birth was normal, code 01 must be indicated. In case of cesarean section or complex birth, deduction code 02 must be indicated.

Amount of social tax deduction

The state provides the maximum possible amount of social tax deduction in the amount of 13 percent of the amount of 120,000 rubles. Accordingly, the taxpayer has the right to return the funds spent within the limits of 15,600 rubles (120,000 rubles * 13%). This requirement does not apply to expensive treatment, which includes a caesarean section. In this case, the costs incurred are reimbursed in full if the costs incurred are documented.

Important! However, if the income tax amounts during the calculation turned out to be less than the possible reimbursement of expenses, the amounts cannot be transferred to the next year.

Is it possible to receive a deduction together with other deductions?

A limit of 120,000 rubles is set in total for all categories of social deductions received by employees during one calendar year. Here is an example of calculating a tax deduction when several cases are combined simultaneously:

During one calendar year, the taxpayer incurred costs for dental treatment in the amount of 30,000 rubles and paid for childbirth in the form of a caesarean section for the wife in the amount of 200,000 rubles. The total cost was 230,000 rubles. Of these, 200,000 rubles are classified as expensive treatment, and are reimbursed to the individual in full (excluding the limit of 120,000 rubles). Accordingly, the taxpayer will receive a deduction in the amount of 30,000*13% + 200,000*13% = 3,900 rubles + 26,000 rubles = 29,300 rubles.

Thus, if the taxpayer's income allows, he can refund exactly that amount.

How many times can you use it?

Deadlines for refunding funds to taxpayers

After checking the taxpayer’s documents, the Federal Tax Service inspectorate sends the individual a notification of the decision made. If it is positive, then the tax authorities must pay the refund amount within one month.

Reasons for refusal to receive a tax deduction

Unfortunately, submission of all documents does not always guarantee that the taxpayer will receive a tax deduction. In some cases, inspectors may refuse to reimburse an individual for the costs of pregnancy and paid childbirth. Among the reasons why tax authorities may refuse to receive funds are the following:

- The documents were not submitted to the inspection in full;

- Income tax was not withheld from the taxpayer's income and, as a result, tax refund is not possible;

- Reports and documents were submitted to the wrong inspectorate;

- The taxpayer has exhausted the social tax deduction limit;

- Checking the 3-NDFL declaration revealed significant violations.

Most asked questions

Question No. 1 Can I get a deduction in my spouse's name?

Answer: In accordance with the provisions of the Civil Code, you can receive a social deduction for pregnancy and paid childbirth both in the name of the spouse and in the name of the spouse.

Question No. 2 Do the tax authorities need original documents?

Answer: Tax officials do not require the submission of original documents. However, it is advisable to have them with you in case questions arise.

Question No. 3 When will the tax deduction be transferred?

Answer: The law established the possibility of transferring social deduction amounts within one month from the date of complete verification of the documents submitted by the taxpayer.

Question No. 4 What is the maximum amount you can receive when applying for a deduction for paid childbirth?

Answer: If the birth is not classified as difficult, then the maximum possible amount to be received is set at 15,600 rubles. If the birth was difficult or a caesarean section was performed, then such births are classified as expensive and are subject to reimbursement in full (13 percent of the taxpayer’s income for the year).

One-click call

During pregnancy, women incur considerable expenses associated with diagnostics, tests, purchasing medications, and so on. A considerable part of the expenses incurred can be reimbursed - something many mothers do not know.

For example, Article 210 of the Tax Code establishes that a taxpayer has the right to receive a social tax deduction for treatment services that were provided to him or his spouse, parents or children before they reached the age of majority, by medical institutions, as well as within the cost of medications prescribed doctor.

Compensation amount

Not all expenses spent on treatment are reimbursed to the taxpayer. Thus, the employee has the right to reduce his taxable income in proportion to the funds spent. In addition, the state reimburses the amount of taxes on personal income withheld in previous tax reporting periods at a rate of 13%.

The tax deduction is provided in the amount of expenses incurred, but not more than 120,000 rubles in the tax period (one year); for expensive types of treatment in Russian clinics, the amount of the tax deduction is accepted in the amount of de facto expenses incurred.

It should also be noted that cash cannot be received, so you must open a bank account.

What are the conditions for receiving social tax deduction?

Treatment services must be provided exclusively licensed medical institutions of the Russian Federation;

Medicines and medicines are clearly defined by the Decree of the Government of the Russian Federation;

The taxpayer has spent his funds;

Treatment was prescribed by the attending physician.

The general list of services is approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201 “On approval of lists of medical services and expensive types of treatment in medical institutions of the Russian Federation, medicines, the amounts of payment for which from the taxpayer’s own funds are taken into account when determining the amount of social tax deduction”, which can be found freely available on the World Wide Web. This Government Decree also defines a complete list (quite extensive) of medicines, the purchase costs of which are subject to reimbursement.

In general, pregnant women have the right to include in tax deductions specialist consultations, examination costs, including ultrasound.

The social tax deduction is provided by the territorial tax authority at the applicant’s place of residence.

Documents required to receive a deduction for treatment expenses:

Application for a deduction;

Certificate of income of the applicant;

A copy of the agreement with the medical institution;

A copy of the license granting the right to provide medical services to the institution;

Evidence of costs for physician services;

You must also submit an approved certificate of payment for medical services.

Necessary documents to receive a deduction in connection with the costs of purchasing medicines:

Statement;

Prescription forms;

Evidence of drug costs;

If the medications were paid for by the spouse - a copy of the marriage certificate;

A copy of the child’s birth certificate, if the medications were paid for;

Certificate of form No. 2-NDFL about income received and taxes withheld from them.

All necessary prescriptions must be written by the attending physician. It is very important that a specific prescription be written on a specially approved form with a note from the attending physician “For the tax authorities of the Russian Federation.”

It should also be noted that the state allows reimbursement of pregnancy expenses incurred in private clinics, provided they have a license for such activities.

Having a child is not only a pleasant chore, but also a significant expense. Few people know that part of the costs of paid pregnancy and childbirth can be reimbursed. The procedure for returning funds spent on treatment, purchasing medications, and assistance during childbirth is regulated by the Tax Code of the Russian Federation and is called a social deduction for treatment expenses (hereinafter referred to as NV, benefit, preference).

How to get a tax deduction? Before describing the procedure and features of obtaining this type of benefit, it is worth saying right away that There may be problems with refunds specifically for paid pregnancy and childbirth management. Not all inspections confirm these types of expenses, since these expenses are not directly stated in the law, and tax authorities do not classify them as medical services. In connection with this, if you are refused, you will have to defend your right in a higher tax authority or court.

What expenses can be reimbursed?

- Paid management of pregnancy and childbirth;

- Complications that arose during pregnancy and childbirth, as well as in the postpartum period;

- Nursing premature babies weighing less than one and a half kilograms;

- Treatment of infertility through IVF;

- Insurance premiums for VHI.

Who can receive NV

- A woman who has incurred expenses for pregnancy and childbirth;

- Spouse;

Conditions for receiving benefits

In order to receive an NV, a number of conditions must be met, in particular:

- The deduction applicant must be a resident of the Russian Federation and have income subject to personal income tax at a rate of 13%;

It is important that the income was at the time of the expenses, and not the statement of the IR.

- Treatment should be carried out in medical institutions of the Russian Federation.

If pregnancy or childbirth took place outside of Russia, then it will not be possible to claim a tax deduction for these expenses.

- A medical institution providing medical services must have a license to carry out medical activities;

Benefit amount

- 120,000 rub. - if the services are ordinary (not expensive). Such a service, in particular, is the management of pregnancy and childbirth (uncomplicated).

It should be noted that this amount is total for all types of social NV. That is, if in one year expenses were incurred, for example, on training and management of childbirth, then the total amount of the tax deduction cannot exceed 120,000 rubles. You need to decide which costs to deduct yourself.

- In the full amount of expenses incurred - if the treatment is considered expensive.

The legislation includes complications during pregnancy and childbirth, infertility treatment, and nursing a premature baby (weighing less than 1.5 kg).

It is worth noting that not all medical services provided during pregnancy, childbirth and the postpartum period can be deducted. The list of ordinary and expensive services for which benefits can be claimed is given in Resolution No. 201 of March 19, 2001.

Example #1

Selivanova A.D. in 2015, she entered into an agreement with Medpomoshch LLC for paid management of pregnancy and childbirth. The total cost under the contract was 110,000 rubles.

Selivanova’s income for 2015 was 558,000 rubles. Personal income tax paid on this amount is RUB 72,540.

Since Selivanova’s expenses did not exceed the established limit, she will be able to receive NV for all costs of pregnancy and childbirth.

The total amount of NV due for refund will be 14,300 rub.

Example No. 2

Selivanova A.D. in 2015, she entered into an agreement for paid management of pregnancy and childbirth worth 110,000 rubles. However, complications arose during the birth process, the mother underwent an emergency operation - a caesarean section, and the child was born premature. The total cost of expenses ultimately amounted to 560,000 rubles. (including emergency surgery, nursing mother and child).

Due to the fact that medical services related to complications during pregnancy and childbirth, as well as nursing a premature baby, are classified as expensive, Selivanova will be able to receive NV from all costs. Thus, the amount of funds received in hand will be RUB 72,800(560,000 x 13%).

Our lawyers know The answer to your question

or by phone:

Features of NV

- This type of NV has a limited application period - 3 years. If the tax deduction is not claimed within the specified period, the right to it will be lost.

- NV for treatment can be declared many times, within established limits;

- In order to accept reimbursement for expenses for expensive treatment, it is necessary that code “2” is indicated in the certificate of payment for medical services. If code “1” is specified, NV will be provided in an amount of no more than 120,000 rubles.

Procedure for obtaining NV

Through the Federal Tax Service:

- Collection of papers (tax return 3-NDFL, certificate 2-NDFL, application for receipt of NV, agreement with a medical institution, certificate of payment for medical services, receipts for payment, additional agreements to the contract and other documents confirming costs. If NV is applied for by a spouse, additional documents must be attached Marriage certificate);

- Sending documents to the tax authority (in person, through a representative, by mail, via the Internet);

- Waiting for the end of the desk audit of the declaration and documents

If the right to NV is denied, the decision of the tax authority can be challenged by filing a complaint against the actions (inaction) of Inspectorate officials to a higher tax authority.

- If the decision is positive, funds will be transferred to the applicant’s NV account after approximately one month from the date of the decision on reimbursement.

By place of work:

- Collection of papers (except for the declaration and certificate 2-NDFL);

- Submission to the tax authority;

- Receipt after a month of a document confirming the right to NV;

- Submitting the received confirmation at the place of work.

If you have any questions or need assistance in preparing documents and filling out tax deduction returns, our on-duty lawyer online is ready to advise you promptly.

In 2011, I underwent long-term, expensive treatment. To receive a % refund from treatment, some documents are required. Question: if throughout the entire treatment I needed to monitor my blood readings and I took such tests in paid laboratories, is % refunded for such tests? Besides receipts from laboratories, do you need any other documents? Also, if the doctor’s visit was paid and there is a contract and receipts, can % be returned for this too? Treatment took place at the Volga Regional Medical Center.

In accordance with subparagraph 3 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax, the taxpayer has the right to receive a social tax deduction, in particular, in the amount paid in the tax period for expensive treatment services provided to him by medical institutions of the Russian Federation.

Decree of the Government of the Russian Federation dated March 19, 2001 No. 201 approved the List of expensive types of treatment in medical institutions of the Russian Federation, the amount of actual expenses incurred, which are taken into account when determining the amount of social tax deduction. The classification of medical services provided as an expensive type of treatment is within the competence of medical institutions.

A deduction for payment of the cost of treatment is provided to the taxpayer if the treatment is carried out in medical institutions that have the appropriate licenses to carry out medical activities, as well as when the taxpayer submits documents confirming his actual expenses for treatment.

To receive this deduction, you need to submit to the tax office at the place of registration a declaration in Form 3-NDFL, a certificate of income in Form 2-NDFL, an agreement for the provision of medical services, a certificate of payment for medical services and payment documents.

Deduction for tests and doctor's appointments

Lyudmila R / October 14, 2014

Can I get a deduction for tests in the Invitro laboratory (myself and my spouse’s) and for doctor’s appointments in the clinic. In what form should these documents be provided to the tax authorities? Thank you.

Sufiyanova Tatyana, Tax consultant / response dated October 14, 2014

Lyudmila, good afternoon.

When paying for services for treatment, you have the right to return income tax and receive a tax deduction for treatment. The deduction for treatment is 120 thousand rubles. in year.

According to sub. 3 p. 1 art. 220 of the Tax Code of the Russian Federation, a citizen has the right to receive a deduction in the amount paid for the tax period (year) for:

Please familiarize yourself with the procedure for obtaining a deduction for treatment.

Tax return information

Who and in what cases must file a 3-NDFL declaration?

Tax return 3-NDFL is a document using which citizens (individuals) report to the state on income tax (NDFL).

At the end of the calendar year, the following groups of persons must fill out and submit the 3-NDFL declaration to the tax authority:

- from the sale of a car;

- from the sale of an apartment/house/land;

- from renting housing;

- from winning the lottery;

- etc.

Example: In 2016, Pushkin A.S. sold an apartment that I owned for less than 3 years. At the end of 2016 (until April 30, 2017), Alexander Sergeevich submitted a declaration to the tax authority in form 3-NDFL, in which the tax payable as a result of the sale was calculated.

I can also fill out and submit the 3-NDFL declaration citizens wishing to receive a tax deduction(refund part of the tax paid). For example:

What is the deadline for filing a 3-NDFL declaration?

Citizens who declare their income (for example, from the sale of property) must submit a 3-NDFL declaration no later than April 30 of the year following the one in which the income was received.

Example: Tyutchev F.I. in 2016, I sold an apartment that I had owned for less than 3 years. Accordingly, until April 30, 2017, Tyutchev F.I. you need to submit a 3-NDFL declaration (which reflects the sale of the apartment) to the tax authority.

The April 30 deadline does not apply to citizens who file a return to receive a tax deduction. They have the right to submit a declaration at any time after the end of the calendar year. The only limitation is that income tax can only be refunded within three years.

Example: Zoshchenko M.M. received paid education in 2014 and worked at the same time (paid income tax). Zoshchenko M.M. has the right to submit documents for a tax deduction (tax refund) for 2014 at any time before the end of 2017.

Note: There is a very common misconception that the tax return must also be filed by April 30th. Let us note once again that this is a misconception, since the April 30 deadline only applies to cases where income is declared.

How to submit a 3-NDFL declaration?

The 3-NDFL declaration is always submitted to the tax authority at the place of registration (registration).

Example: Citizen Ivanov I.I. registered (registered) in Ivanovo, but has temporary registration in Moscow. In this case, Ivanov I.I. must submit a declaration to the Ivanovo tax office.

You can submit a declaration to the tax authority in the following ways: in person, by mail (by a valuable letter with a list of attachments), via the Internet. You can read a detailed description of each filing method with all the subtleties in our article Submitting a 3-NDFL return to the tax authority

How to fill out the 3-NDFL declaration?

You can fill out the 3-NDFL declaration in the following ways:

- take advantage of the convenient service on our website. The program does not require special knowledge. By answering simple and understandable questions, you will be able to download the 3-NDFL declaration ready for submission to the tax authority.

- fill out the form manually. On our website you can find Forms and Forms of the 3-NDFL declaration, as well as samples of completion.

- use the program from the Federal Tax Service. The program requires some understanding of the 3-NDFL form and knowledge of your tax office and OKTMO code.

- in person at the nearest tax office;

- by registered mail;

- on the website nalog.ru.

Responsibility and penalties for failure to submit and late submission of the 3-NDFL declaration

If the 3-NDFL declaration is not submitted on time, the tax inspectorate may impose a fine under Article 119 of the Tax Code of the Russian Federation. The fine will be 5% of the unpaid tax amount (which must be paid according to the declaration) for each full or partial month from the date of delay (April 30). In this case, the minimum amount of the fine is 1,000 rubles, and the maximum is 30% of the tax amount.

Example: In 2015, Semyon Semenovich Sidorov sold the apartment and had to pay 70,000 rubles. tax on income from this sale. Sidorov S.S. missed the deadline for submitting the 3-NDFL declaration (April 30, 2016) and submitted it only after a letter from the tax authorities on June 10, 2016.

The amount of the fine Sidorov S.S. will be: 2 months. x (70,000 x 5%) = 7,000 rub.

Please note that fines apply only to cases where filing 3-NDFL is mandatory (for example, when receiving income from the sale of property) and does not apply to voluntary cases of filing a 3-NDFL declaration (for example, when receiving tax deductions).

Refund for test fees

What documents are needed to submit a Tax Return to the Tax Service for a 13% refund for paying for tests?

Do I need an agreement with a medical institution?

Documents required to be presented to the tax office for tax deduction for tests:

1. copy of the agreement

2. copy of payment documents

3. copy of license

4. certificate of medical payment. services

Declaration 3-NDFL, certificate 2-NDFL about salary

Add a comment Cancel reply

Hello. In 2017, my husband and I bought an apartment. In 2018, we filed tax refund returns for 2017 for both me and my husband. Can we file returns again this year and get a tax refund for 2015-2016?

Good afternoon. Tell me, the apartment was bought in 2017 with a mortgage for 800 thousand, and in the same year another one was sold for 300 thousand, owned for less than 3 years. And included in the mortgage. What declaration sheets need to be filled out to avoid paying tax?

Good afternoon In 2015, medical expenses were incurred; in 2016, she underwent additional studies at a driving school to obtain a category D license. In 2015-2016, she did not officially work. Can I reflect the expenses of 2015-2016 in the 3 personal income tax declaration for 2017? Thank you!

Hello. In January 17, my husband sold 1/2 of the apartment he inherited (the second part of the apartment was bequeathed to his sister) in 16. There was only one sale agreement, for the amount of 1,480 thousand rubles. When filling out the declaration, he was assessed a tax in the amount of 31,200 rubles. My husband buys a car, finishes building a house (bought unworthy back in 2000), in October 17 he will move...

If my husband is registered in another region, and I am currently on maternity leave since 2016 (since April 10), which tax office should I apply for a deduction for my own and the treatment of my child (under 18 years old) at my husband’s place of residence? Or at my place of residence? - if the return for 2017 and 2018 (later) is issued to the husband

How can a child who has reached the age of 18 and has no income (a student has a scholarship) receive a social deduction for his treatment?

Good afternoon The apartment was purchased with a mortgage and in common joint ownership with my husband, under a shared construction agreement in 2016. The cost of the apartment is 1,424,150 rubles. The transfer and acceptance certificate was signed on December 29, 2017. We will write a statement on the distribution of income, is the date of the statement important for the tax authorities? The interest paid to the bank since 2016 and at the moment is 193,226.71 tr. Tell me how to go...

Hello. I have a question regarding the priority of personal income tax returns. If expenses for treatment and the purchase of real estate were made in the same period, which deduction is returned first? I realized that it is necessary to reflect both expenses in one declaration. But then it turns out that the property deduction will completely cover the entire personal income tax for the year. And go...

How to get money back for treatment

Instructions for those who were treated in a paid clinic

I hate being treated in government clinics.

It’s easier for me to pay than to stand in line to see a tired grandmother doctor. Therefore, for any illness, I go to a paid clinic.

In 2015, I spent RUR 18,800 on diagnostics, consultations and procedures. In 2016, I applied for a tax deduction for treatment and returned 2,500 RUR. I’ll tell you how to do the same.

What is a tax deduction for treatment

A tax deduction is money that the state returns to you from the personal income tax you paid if you do something useful for the state. There are tax deductions for purchasing an apartment and studying. Today we’ll talk about deductions for paid medical services.

How to take your 260 thousand from the state

Under medical services, the tax code means appointments with a doctor, diagnostics, medical examination, testing, hospitalization, treatment in a day hospital, dentistry, and prosthetics. The list includes everything that a sick person usually encounters.

Surgeries, including plastic surgery, IVF, and treatment of serious illnesses, belong to the category of expensive treatment. They receive another deduction for them, but more on that next time.

You can also receive a deduction for voluntary health insurance if you paid for the policy yourself. If the employer paid for it, then no deduction will be made.

The size of the deduction depends on the cost of treatment: the more you spent, the more you will get back. But the maximum cost of treatment, which is taken into account when calculating the deduction for treatment, is 120,000 RUR. This is the general limit for almost all social deductions, in particular for the costs of treatment and education (see paragraph 2 of Article 219 of the Tax Code of the Russian Federation). Even if you paid a million at the hospital, you will receive a deduction as if you paid 120 thousand.

Who can get a deduction

If you receive a salary or have income from which you pay personal income tax, you can receive a deduction. Non-working pensioners, students and women on maternity leave do not have such income; they do not pay personal income tax, so they do not specifically claim this deduction.

You will also get your money back if you paid for the treatment of your parents, spouse, or children under 18 years of age. To do this, you need a document confirming the relationship: a marriage certificate or birth certificate. You will not be given a deduction for paying for the treatment of your mother-in-law or father-in-law.

It doesn’t matter who the treatment contract is for. But the payment document must be issued to the person who will receive the deduction.

For example, an elderly father was hospitalized and his daughter wants to file a deduction for his treatment. The contract can be drawn up either for the father or for the daughter, but payment documents can only be for the daughter. If the payment documents are issued to the father, the clinic will not give the daughter a tax certificate. It is best if both the contract and the payment papers contain the details of the person who will issue the deduction. In our example - daughters.

How much money will be returned

The amount of the deduction depends on the size of your salary and the cost of treatment. In any case, the tax office will not return more money than the personal income tax paid for the year. Let's look at an example:

Vasily works as a manager and earns 40,000 R per month. During the year he earned 480,000 RUR.

He gives 13% of his salary to the state as tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 RUR.

In 2015, he spent RUB 80,000 on treatment. Vasily collected documents and applied for a tax deduction.

After submitting the application, the tax office will deduct the amount of treatment from Vasily’s income for the year and recalculate his personal income tax: (480,000 − 80,000) × 0.13 = 52,000 RUR.

It turns out that Vasily was supposed to pay 52,000 RUR, but in fact paid 62,400 RUR. The tax office will return the overpayment to him: 62,400 − 52,000 = 10,400 RUR.

The deduction can be issued within three years from the date of treatment. In 2017, you can receive a deduction for treatment in 2016, 2015 and 2014. The date and month don't matter.

How it works

To receive money, you first need to collect evidence that you were treated and paid: contracts, checks and certificates from the clinic. Then fill out the 3-personal income tax declaration on the tax website and send it along with scanned documents for verification.

After the declaration is approved, you must write an application for a refund. According to the law, one month after submitting the application, the tax office must transfer money to your account.

We talk not only about deductions, but also about how not to overpay for treatment, save money from scammers, earn more and spend rationally.

You can do everything gradually. I was in no hurry and prepared the documents for about three months.

At the clinic's cash desk or reception desk you will be given a contract and a receipt. Save these documents: only they confirm the fact of payment for treatment. Attach the check to the contract with a paper clip or stapler. Then you’ll be exhausted trying to figure out which contract is which check.

Agreement and receipt from a paid clinic

Agreement and receipt from a paid clinic

Go to the registry or accounting department and ask for a tax certificate. Show your passport, tax identification number, agreement with the clinic, all receipts.

Passport, agreement with the clinic and Taxpayer Identification Number - take these documents with you when you go to get a tax certificate

Passport, agreement with the clinic and Taxpayer Identification Number - take these documents with you when you go to get a tax certificate

Some clinics do not require receipts. They take information about the services provided from their database. But not everyone does this. I lost several receipts, and the girl at the reception did not include them in the certificate amount.

If you are applying for a deduction for the treatment of relatives, bring your marriage certificate or birth certificate along with the documents and ask for a certificate to be issued in your name.

At the clinic I visited, the certificate is issued in a maximum of 5-7 days. I came at a deserted time, so they gave me a certificate in half an hour.

Help for the tax office. Please note the service code: it must be 1 or 001

Help for the tax office. Please note the service code: it must be 1 or 001

If you doubt that the certificate has been completed correctly, check whether it complies with the instructions of the Ministry of Health. Usually this problem does not arise. If the clinic has a license, it is obliged to issue a correctly executed certificate.

Along with the certificate, you will be given a copy of the license to practice medicine. If the clinic does not have a license or its validity has expired, the tax office will not return anything to you. A copy of the license remains with you; it does not need to be sent to the tax office.

Check the license expiration date. Most often, a license is issued for an indefinite period, but it’s better to be safe than sorry

Check the license expiration date. Most often, a license is issued for an indefinite period, but it’s better to be safe than sorry

Scan a certificate from the clinic and the contract to send them to the tax office remotely. If you receive a deduction for the treatment of parents, spouse, children under 18 years of age, then make a scan of your marriage certificate or birth certificate.

The tax website accepts files in the formats .txt, .doc, .docx,

.pdf, .gif, .bmp, .jpg, .jpeg,

.png, .tif, .tiff, .zip, .7z, .rar,

.arj, .xls, .xlsx

Take certificate 2-personal income tax from the accounting department at work. The data from this certificate will be needed to fill out the declaration. You don't need to scan it.

Documents can be submitted in three ways:

The first two methods didn’t suit me: I didn’t want to stand in lines. I spent the evening and submitted documents on the website.

How to submit documents for deduction on the tax website

Submitting documents to the tax office is easy. The general logic is this: fill in personal data, indicate income and upload evidence of treatment expenses. To help you avoid confusion, we have prepared six-step instructions.

1. Go to the taxpayer’s personal account and select the section “Income Tax” → Personal Income Tax.

2. Fill in your passport information. If you indicated the TIN, then the date, place of birth, passport details and citizenship do not need to be filled in.

3. We indicate the employer and income. Here you will need a certificate 2-NDFL. The first paragraph of the certificate contains information about the employer (TIN, KPP and OKTMO).

4. Select the deduction that you want to receive. The deduction for treatment is located in the “Social tax deductions” group. Enter the amount you spent in the “Treatment expenses” window.

Please note: medical expenses and expensive treatment expenses are two different things. We are only talking about deductions for treatment.

5. Check the numbers and click the red “Generate file to send” button.

6. Add scanned certificates and contracts. We sign with an electronic signature and click “Sign and forward”. If you do not have an electronic signature, register it in your personal account in the “Profile” → “Obtaining an electronic signature verification key certificate” section.

That's it, you have sent your declaration to the tax office. The inspector is obliged to check it within three months. There are no notifications about checking the declaration, so I checked my personal account once a month.

A month and a half later, my declaration was approved.

Even if your declaration is approved, the money will not be returned without an application. Go to the Federal Tax Service website again:

In the application, your full name and passport data will be loaded automatically. You need to enter the account details where you want to receive the money.

Please see your personal account on the bank’s website for details. In Tinkoff Bank, go to your personal account on the “About Account” tab:

After you submit your application, the money will be credited to your account within a month. You will receive a message about this from the bank.

SMS about money back. 042202001 - details of the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 2 for the Nizhny Novgorod region. Your tax office may have a different code.

SMS about money back. 042202001 - details of the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 2 for the Nizhny Novgorod region. Your tax office may have a different code.

Deduction for testing costs

Right to deduction

Subclause 3 of clause 1 of Art. 219 of the Tax Code of the Russian Federation provides for a social tax deduction for personal income tax in the amount of expenses for medical services provided by medical organizations and individual entrepreneurs engaged in medical activities. It is provided in relation to medical services specified in the list established by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201 (hereinafter referred to as the List). The List includes services for diagnosis, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practice doctors), including medical examinations.

According to the All-Russian Classifier of Economic Activities, Products and Services OK 004-93, approved by Decree of the State Standard of Russia dated August 6, 1993 No. 17, laboratory testing services are classified as outpatient treatment services provided by polyclinics (code 8512000 “Outpatient treatment services provided by polyclinics and private medical practice" includes code 8512400 "Laboratory tests provided in clinics"). Thus, since taking tests is part of the medical services specified in the List, a social tax deduction for personal income tax, provided for in subsection. 3 p. 1 art. 219 of the Tax Code of the Russian Federation. The Russian Ministry of Finance confirms that if medical services for paid tests are included in the List, the taxpayer has the right to receive a social tax deduction in the amount of expenses incurred by him to pay for tests (letter dated April 27, 2016 No. 03-04-05/24414).

Please note that based on clause 3 of Art. 210 and paragraph 1 of Art. 219 of the Tax Code of the Russian Federation, the deduction is provided only in respect of income subject to personal income tax at a rate of 13% (this, in particular, salary, remuneration under civil contracts, income from property rental, etc.). In the absence of such income, the right to deduction does not arise. For example, pensioners whose only income is a pension cannot receive a deduction, since state pensions and labor pensions assigned in the manner established by current legislation are not subject to personal income tax (clause 2 of Article 217 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated 08/07/2015 No. 03-04-05/45660).

The maximum deduction amount is RUB 120,000. for the calendar year (clause 2 of article 219 of the Tax Code of the Russian Federation). Moreover, this amount also includes other social tax deductions listed in subparagraph. 2-5 p. 1 tbsp. 219 of the Tax Code of the Russian Federation (for training, payment of pension contributions under the agreement (agreements) of non-state pension provision and (or) voluntary pension insurance, as well as voluntary life insurance, payment of additional insurance contributions for a funded pension). If there is a right to several social tax deductions, the taxpayer independently chooses which types of expenses and in what amounts are taken into account within the maximum amount of the social tax deduction.

Supporting documents

The Tax Code does not say which documents are required to confirm the right to a deduction. In letter dated March 21, 2016 No. 03-04-05/15472, the Russian Ministry of Finance noted that regarding the list of documents confirming actual expenses for medical services provided, you should contact the tax office.

The Federal Tax Service of Russia, by letter dated November 22, 2012 No. ED-4-3/, sent to the lower tax authorities exhaustive lists of documents attached by taxpayers to their personal income tax returns in order to obtain tax deductions. It follows from the letter that in order to provide a social deduction for the costs of paying for medical services, you need a copy of the treatment agreement with appendices and additional agreements to it (if concluded) and a certificate of payment for medical services (original). That is, if no contract was concluded, one certificate of payment for medical services will be sufficient to receive a deduction. The Russian Ministry of Finance confirms that the taxpayer has the right to exercise his right to receive a deduction by submitting a personal income tax return and a certificate of payment for medical services to the tax authority (letter of the Russian Ministry of Finance dated March 12, 2015 No. 03-04-05/13176).

The form of the certificate of payment for medical services was approved by order of the Ministry of Health of Russia No. 289, Ministry of Taxes of Russia No. BG-3-04/256 dated July 25, 2001. It is filled out by all healthcare institutions licensed to carry out medical activities, regardless of departmental subordination and form of ownership. The certificate is issued at the request of the person who paid for medical services, upon presentation of payment documents confirming payment. Please note that the certificate must be issued not only when paying for services at the cash desk of a medical organization, but also when making non-cash payments for medical services through a bank (decision of the Supreme Court of the Russian Federation dated May 23, 2012 in case No. AKPI12-487).

Thus, to obtain a certificate, you need to contact the clinic where the tests were taken and present payment documents confirming payment for the services provided for the tests.

How to get a deduction

The deduction can be provided by the tax office or the employer (clause 2 of Article 219 of the Tax Code of the Russian Federation).

To receive a deduction from the tax authorities, after the end of the calendar year in which the expenses for paying for the tests were incurred, you must submit a personal income tax return to the tax office at your place of residence. Its form was approved by order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/ The declaration can be submitted within three years from the year in which the right to receive a deduction arose (letter of the Federal Tax Service of Russia for Moscow dated June 26, 2012 No. 20-14 /). In addition to the above documents confirming the right to deduction, you must attach to the declaration the details of the bank account to which the tax authorities will return the excess tax withheld. We also recommend having copies of payment documents, as some tax offices require them.

You don’t have to wait until the end of the year and get a deduction from your employer. To do this, you need to obtain a notification from the tax authority at your place of residence confirming your right to a social tax deduction. Its form was approved by order of the Federal Tax Service of Russia dated October 27, 2015 No. ММВ-7-11/ To receive the notification, you must submit an application to the tax authorities and attach documents confirming the right to deduction. When filling out an application (its form is usually provided by the inspectorate), you will need to indicate the name, INN and KPP of the employer who will provide the deduction. The notification is issued by tax authorities within 30 days from the date of submission of the application and documents (Clause 2 of Article 219 of the Tax Code of the Russian Federation).

Then you need to apply for a deduction to the employer and attach the received notification to it. The employer will provide a deduction starting from the month in which the employee applied to him to receive it (Clause 2 of Article 219 of the Tax Code of the Russian Federation).

Is it possible to get a tax deduction for paid tests?

This article was written to provide a more detailed answer to one of the questions of site visitors. In my articles, I have already touched on the topic of tax deduction for dental treatment and general issues of tax deduction for treatment. Here we will consider the issue of obtaining a tax deduction for paid analyzes.

Question from Galina: Hello! Is it possible to get a tax deduction not for treatment, but for paid tests?

And the second question. The medical center only issues a receipt for the cash receipt order, there is no cash receipt. They say that they are not required to issue both a receipt and a check, just one is enough. They are right? Or will they still not give me a deduction without a cash receipt? Thank you.

It should be recalled that the medical tax deduction is a type of social deduction provided to the taxpayer if he incurs expenses for paying for treatment services at a medical institution and purchasing medicines.

It should be recalled that the medical tax deduction is a type of social deduction provided to the taxpayer if he incurs expenses for paying for treatment services at a medical institution and purchasing medicines.

Subclause 3, clause 1, art. 219 of the Tax Code of the Russian Federation provides that medical deductions are provided in the amount paid by the taxpayer in the tax period for medicines and treatment services provided to him, his spouse, parents, and children under the age of 18.

Decree of the Government of the Russian Federation dated March 19, 2001 N 201 approved the lists of medical services and expensive types of treatment in medical institutions of the Russian Federation, medicines, amounts, payments for which from the taxpayer’s own funds are taken into account when determining the amount of social tax deduction.

The deduction is applied to payment for those types of expensive treatment, medical services and medicines that are named in the lists approved by Decree of the Government of the Russian Federation of March 19, 2001 N 201 (hereinafter referred to as Decree N 201).

Add to list medical services included the following services:

- Diagnostic and treatment services when providing emergency medical care to the population.

- Diagnostic services, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

- Diagnostic and prevention services, treatment and medical rehabilitation when providing inpatient medical care to the population (including in day hospitals), including conducting a medical examination.

- Services for diagnosis, prevention, treatment and medical rehabilitation when providing medical care to the population in sanatorium and resort institutions.

- Health education services provided to the public.

- FEDERAL LAW OF THE RUSSIAN FEDERATION dated July 19, 2011 No. 247-FZ On social guarantees for employees of internal affairs bodies of the Russian Federation and amendments to certain legislative acts of the Russian Federation (As amended […]

- Article 15. Resignation of a judge Federal Law No. 169-FZ of December 15, 2001 amended Article 15 of this Law. The effect of Article 15 (with the exception of paragraph 3) of this Law is extended to judges who retired from this […]

In this list there is no direct indication of the type of medical service – “analysis”.

It should be assumed that analysis is a research method and a necessary component of the diagnosis. In medicine, diagnosing is the process of establishing a diagnosis, that is, a conclusion about the essence of the disease and the patient’s condition.

In paragraph 2 of Resolution No. 201 of the list of medical services provided to the taxpayer, diagnostic services, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

According to the All-Russian Classifier of Types of Economic Activities, Products and Services OK 004-93, approved by Decree of the State Standard of Russia dated 06.08.93 N 17, laboratory tests are indicated under code - 8512400 (Laboratory tests provided in clinics).

Paragraph 3 of Resolution No. 201 also provides as a medical service - diagnostic service.

Thus, it turns out that not only the treatment itself in the literal sense, but also such a diagnostic method as analysis is considered as a service.

I believe that from the above it follows that the taxpayer has the right to receive a tax deduction as a medical service - diagnostic services, in particular, by the analysis method, but subject to other conditions for obtaining a tax deduction established by the Tax Code of the Russian Federation.

Tax inspectorates indicate that Resolution N201 and the Tax Code of the Russian Federation itself do not contain a direct reference to this type of medical service, and therefore the taxpayer will have to defend this position. You also have the right to seek official clarification from the tax office.

As for the second part of the answer, according to paragraph 2 of Art. 2 “Organizations and individual entrepreneurs, in accordance with the procedure determined by the Government of the Russian Federation, can make cash payments and (or) payments using payment cards without the use of cash register equipment in case of provision of services to the population subject to their issuance of the appropriate strict reporting forms.

The procedure for approving the form of strict reporting forms equated to cash receipts, as well as the procedure for their recording, storage and destruction, is established by the Government of the Russian Federation.” Decree of the Government of the Russian Federation dated May 6, 2008 N 359 approved the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment.

The Regulations state that organizations and individual entrepreneurs providing services to the public can independently develop and use documents equivalent to cash receipts, intended for making cash payments and (or) payments using payment cards without the use of cash registers. Thus, it follows that documents (receipts, tickets, coupons, etc.) are drawn up on strict reporting forms, which must necessarily contain all the details established in clause 3 of the Regulations.

Agreement for the sale and purchase of an unfinished construction project and a land plot City ________ "__" ___________201_ We, gr. RF ___________________________________, __ _________ 19__ year of birth, passport of a citizen of the Russian Federation __ __ […] Law of the Russian Federation of May 29, 1992 N 2872-I “On Pledge” (with amendments and additions) (lost force) Law of the Russian Federation of May 29, 1992 . N 2872-I “On Pledge” With amendments and additions dated: July 26, 2006, July 19, 2007, December 30, 2008, November 21, 6 […]

Due to the fact that the tax regulation system established in Russia requires citizens of our country to receive a social tax deduction if they have incurred costs for their treatment, taxpayers have the right to return part of the funds spent on medical services. For this purpose, taxpayers have the right to submit documents to the inspectorate and receive a tax deduction for paid childbirth and pregnancy management.

Tax deduction for paid childbirth and pregnancy management: who can and cannot receive a deduction

Art. 219 of the Tax Code of the Russian Federation determines that if the taxpayer has incurred costs associated with receiving medical services, then the state must reimburse 13% of the costs incurred.

Important! Expenses for pregnancy and paid childbirth of a woman also fall into the category of services, the partial cost of which the taxpayer has the right to reimburse.

Before submitting documents to the inspectorate, it is necessary to determine whether the taxpayer belongs to the category of persons entitled to receive a deduction. Both a woman and her husband can receive a social deduction for paid childbirth and pregnancy management, provided they meet the following criteria:

Conditions for providing a tax deduction

You can receive a tax deduction for paid childbirth and pregnancy management for the following types of services: (click to expand)

- Medical consultation with doctors of all specialties;

- All types of body diagnostics (ultrasound, screenings, tests, etc.);

- Treatment of women during pregnancy, both inpatient and outpatient;

- Childbirth carried out on a paid basis;

- Medicines purchased according to a prescription from a supervising physician.

It should be noted that all treatment services must be provided only by medical institutions of the Russian Federation that have the appropriate license.

Deduction for expensive treatment during childbirth (caesarean section, difficult childbirth, etc.)

The procedure for filing a deduction for paid childbirth

In order to receive a tax deduction for pregnancy and paid childbirth, the recipient must collect the necessary package of documents and submit them to the Federal Tax Service inspection at the place of their registration.

Important! Even though inspectors require copies of documents from individuals, the originals should still be taken with you for confirmation.

After submitting the documents, tax authorities have three months to verify the documents for the provision of a deduction. After this period, Federal Tax Service employees send a notification with the decision made.

Required documents to receive a deduction

A spouse, wishing to receive a deduction for pregnancy and paid childbirth, must collect and submit the following documents to the inspection: (click to expand)

- Passport of a citizen of the Russian Federation - recipient of a tax deduction;

- Certificate of income for the past year issued by the employer;

- If the deduction will be issued to a spouse, it is necessary to confirm the marital status with a marriage certificate and the spouse’s passport;

- Declaration in form 3-NDFL;

- Agreement with a medical institution and an act on the provision of medical services;

- All payment documents confirming the costs incurred by taxpayers for pregnancy and paid childbirth;

- Details of the account to which the refund will be made.

Where to submit documents to receive a deduction

After filling out a declaration for reimbursement of monetary expenses and preparing documents, the taxpayer has the right to contact the Federal Tax Service inspectorate at the place of his registration. The law allows the following methods of providing documents to inspection employees:

| p/p | Method of submitting documents to receive a deduction | Advantages | Flaws |

| 1 | Personal visit | This method has proven itself to be the most reliable, since tax authorities often review the documents submitted by the taxpayer immediately upon delivery. In this case, if any shortcomings are detected, the Federal Tax Service employee will immediately notify the individual of the need to make corrections. | However, not every working citizen can take the time to go to the inspectorate. |

| 2 | Postal services | It makes sense to provide documents in this way only if the post office is within walking distance, and the tax office is very far away. | A significant disadvantage of such a transfer of the declaration is that if errors are identified, the taxpayer will learn about it after several months. As a result, the process of receiving a social deduction will be much longer. |

| 3 | Personal account of the Federal Tax Service | A one-time visit to the Federal Tax Service will allow you to solve many tax problems in the future without leaving your home. | Registration on the inspection website requires visiting the tax office to obtain a login and temporary password. |

| 4 | Portal "Government Services" | You can register on the Gosuslugi portal without leaving your chair by logging in using your identification document. | No deficiencies identified |

| 5 | Contacting your employer to receive a tax deduction | The employer can also become an intermediary between the taxpayer and the inspectorate when submitting documents. The advantage of contacting the company's accounting service is that the employee does not have to wait until the end of the tax period. | However, in the case when you need to receive a deduction not for the past year, but for previous periods, you can only contact the Federal Tax Service inspectorate. |